Well, the bulls took the ball and ran with it. The S&P 500 Index (INDEXSP:.INX) pushed to new all-time highs this week, finishing up another 1.5 percent.

But the market is getting stretched, following a 13 day surge of over 8 percent (trading days).

The positives include expanding market breadth and technical breakout. Those two variables should be enough to keep an overbought market pullback within 3-5 percent. BUT the 2100 price area will be a key support to watch should the market begin to sell off.

No need to speculate, though – the price action will lead us.

We have some great investing reads in this week’s edition of “Top Trading Links” . Enjoy.

MARKET INSIGHTS

Institutional Investors return expectations are getting wonky – Ben Carlson

Sector Breadth Confirms Equity Strength – Andrew Thrasher

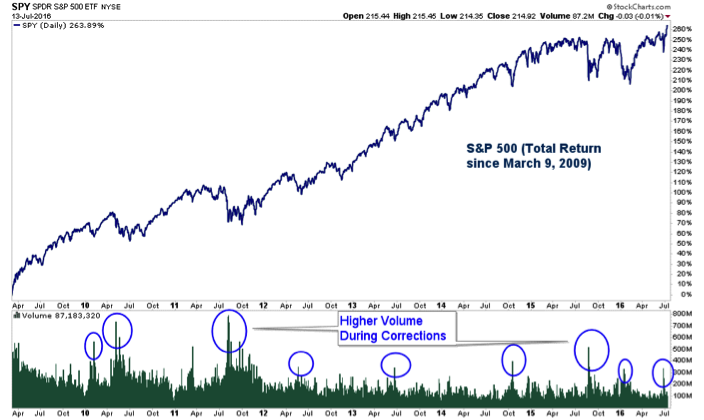

A look at volume in the S&P 500 ETF (SPY) – Charlie Bilello

The Folly of Stock Market Forecasting – Alpha Architect

This will end badly – FMD Capital

Is resource reflation for real? – Dana Lyons

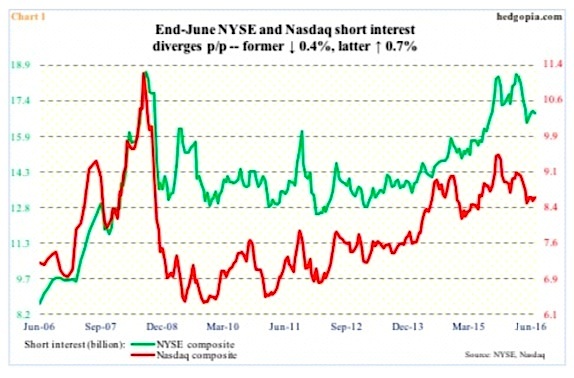

A look at stock market short interest – Paban Raj Pandey

The prime example of an untradeable stock – Tom Bowley

New Highs in U.S. retail sales and wage growth – Urban Carmel

NEWS & RESEARCH

Twitter is betting big on streaming – Business Insider

The majority of links shared on social media aren’t actually read by sharers – NY Daily News

Declinism is a trick of the mind – The Guardian

The Failure Generation – Zenolytics

Pokemon Go’s mental health benefits are real – engadget

Is there a future in armed police robots? – Defense One

A feature on Under Armour CEO Kevin Plank – Bloomberg

The U.S. presses China to responsible after South Sea ruling – Bloomberg

98% of us don’t read terms of service – Eric Brown

Be sure to check back next weekend for another edition of Top Trading Links. Thanks for reading!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.