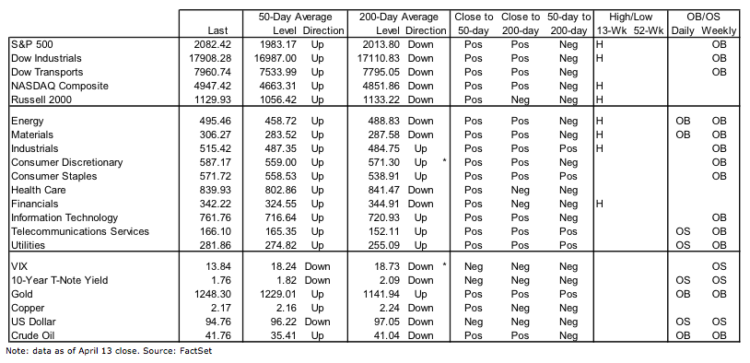

After a brief respite that lead many to believe a pullback was in the works, the S&P 500 Index gained 1.7 percent last week. This puts this index at 2080 and within just 2.5 percent of its all-time highs.

Stocks are definitely getting ahead of themselves (i.e. overbought) but that doesn’t mean that the engine under the hood hasn’t received some enhancements over the past 2 months.

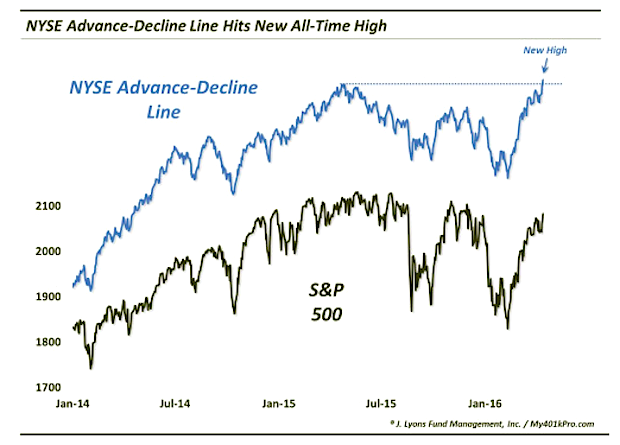

In February, market breadth was dismal. On Wednesday, the NYSE Advance-Decline line made new highs (see Dana Lyons post below). Yup, we went from end of the world, to an outsized breadth expansion.

But don’t let that lull you to sleep. Earnings are here and the market could see some volatility through the end of April.

Let’s get right to it. There are some great trading links this week!

MARKET & TRADING INSIGHTS

Index Shorts are staying stubbornly short – Paban Raj Pandey

5 things to watch in the dollar index – Greg Harmon

Three emerging market themes in April – Willie Delwiche

The earnings sweet spot has begun to sour – LPL Financial

Why the S&P 500 may be headed to all time highs – Dana Lyons

Are you aware of the Rubicon Project – Greg Schnell

Is it time to put some junk (bonds) in your trunk – Chris Kimble

Insights from the latest Merrill Lynch fund manager survey – Tiho

Winning Trader, Whining Trader – Steve Burns

Do few things extremely well – Pradeep Bonde

The five mistakes every investor makes – Meb Faber

How ever decision can make you richer or poorer – Mark Ford

NEWS & RESEARCH

Facebook is trying live streaming video – Harvard Business Review

Staggering declines in venture capital / startup funding – Matt Rosoff

The four building blocks of change – McKinsey and Co

Video: Peter Thiel on tech, china and more – Bloomberg

Mobileye is worth 11 per share – Citron Research

Thanks for reading and be sure to check back next weekend for another round of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.