The underlying bid for stocks continues on. The S&P 500 gained 0.5 percent last week as investors digested earnings.

One nice surprise for bulls is how well investors have received bank earnings. Whether that reaction holds or not remains to be seen, but the banks have been very strong in April.

Looking forward, the market will continue to battle a thick band of resistance. And it may take some time to chew through it. On the S&P 500, that resistance starts around 2100 and runs up to all-time highs around 2130.

We are moving very quickly into the end of a seasonal period – will ‘Sell In May” come into play again this year?

Without further adieu, let’s get after it. Here’s the best of the week that was in the week’s “Top Trading Links.”

MARKET INSIGHTS

How Stanley Druckenmiller is a money making machine – Market Wisdom

Five Tips for getting started in ETF investing – David Fabian

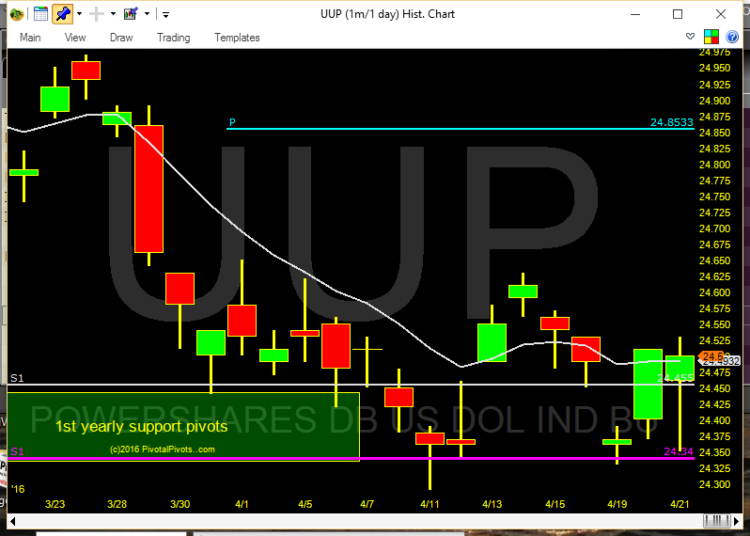

U.S. Dollar Index is set to rally – Jeff York

Trading edge vs trading edge – Adam H. Grimes

Why Silver should continue to shine – Tom Bruni

There’s no secret about what’s going on with this chart – John Butcofski

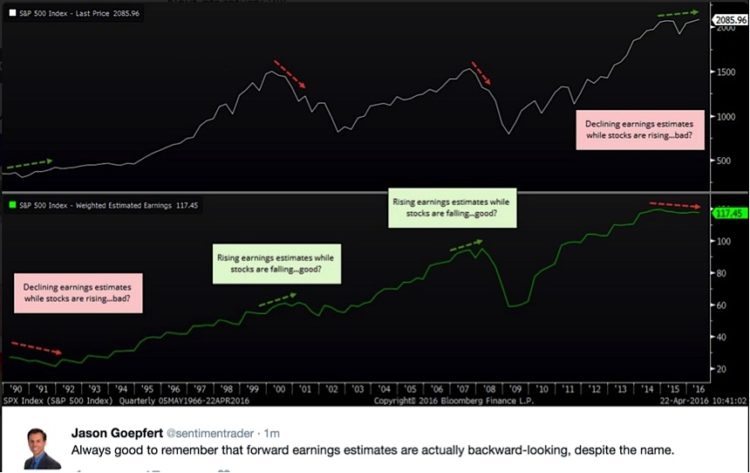

Forward earnings estimates are actually backward looking – Jason Goepfert

Barry Ritholtz interviews Tom Dorsey

Succeeding greatly by failing often – Brett Steenbarger

Aswath Damodaran likes Valeant as a value investing idea. Chris Kimble sees a technical bounce setup in it as well

INVESTING NEWS & RESEARCH

Here come unregulated GMOs – Antonio Regalado

Twitter has momentum with teens – Gary Vaynerchuk

VC mega rounds slow to a crawl– CB Insights

More CRISPR companies are looking to come public – Alex Lash

Argentina had a record setting bond sale – Bloomberg

Another problem with fast food – Roberto Ferdman

Housing prices in San Francisco fell for the first time in four year – Akin Oyedele

Apple’s organizational crossroads – Ben Thompson

Thanks for reading and be sure to check back next weekend for another round of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.