As market volatility picks up, it’s become increasingly clear to all of us that our mind plays tricks on itself. It’s a major reason why we have stop losses, trading rules and processes.

As market volatility picks up, it’s become increasingly clear to all of us that our mind plays tricks on itself. It’s a major reason why we have stop losses, trading rules and processes.

If you are failing to follow your plan, that needs to change now. In this kind of market, you will get killed. It will help if you have some understanding of what is or why things are going wrong. That’s a main theme in this week’s Investor Insights.

Enjoy this week’s “Top Trading Links”. It’s truly badass.

MARKET INSIGHTS

@TheFibDoctor analyzes S&P 500 market pullbacks over the last ten years:

Peter Brandt calls out the critical price action in the Yuan:

$USDCNH Monthly chart indicates the multi-decade trend in #YUAN is over. Read analysis here https://stks.co/h2xCs

— Peter Brandt (@PeterLBrandt) Aug. 11 at 09:58 AM

High Yield bonds are yet another warning sign in the markets via @JLyonsFundMgmt

@SJosephBurns latest post breaks down the things traders need to overcome to be successful. Here are the first few:

Chris Kimble notes Barron’s call out for the bottom in commodities. This doesn’t look like a bottom to me!

Leading magazine feels the low in commodities is here. Will they be on track again? $USO https://t.co/PbpJfQL9dP $TLT pic.twitter.com/LL9wIVkEUL

— Chris Kimble (@KimbleCharting) August 11, 2015

@sentimentrader breaks down S&P 500 death crosses.

Buy the Dow after a “death cross” and out on reversal since 1900. It usually won, but when it fails it fails big. pic.twitter.com/QiO7zh22Xv

— Jason Goepfert (@sentimentrader) August 11, 2015

@JFinDallas breaks down last week’s IPO happenings and trading action.

What a thought provoking quote from Ed Seykota:

“The turning point in our Process occurs when you become willing to feel a historically unpleasant feeling.” – Ed Seykota

— Gavin McMaster (@OptiontradinIQ) August 13, 2015

Tuesday’s stock market reversal was incredible:

Last time $SPX traded down 1.5% and finished up was October 4, 2011, + 11.5% 1 month later… but mileage may vary

— Jon Markman (@jdmarkman) Aug. 13 at 08:40 AM

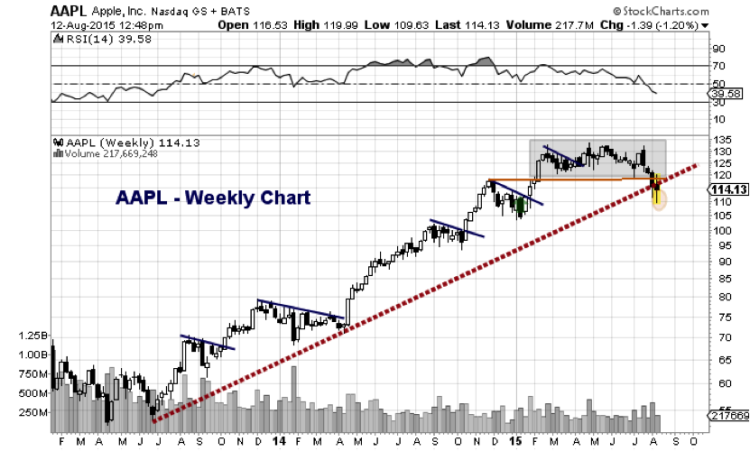

@andrewnyquist digs into Apple’s stock chart as it dances around a major trend line.

@TradingOnMark looks at US Treasuries incorporating Wave Theory.

INVESTOR INSIGHTS

Barry Ritholtz interviewed the ‘Financial Advisor’s Advisor’ Nick Murray. Here are a few of my notes.

- If alpha takes you over opposed to outcomes, I think you’re dead in the marketplace.

- The dominant determinant of long term financial outcomes is not investment performance, it’s investor behavior.

- What makes a successful financial advisor? Somebody who can make a plan for his clients empathetically and bravely regardless of the fads or fear of the moment

- Clients who are hell bent on self destruction make it known within 20 minutes of a conversation.

- Why you can never get truth from media, you can only get news: People either get bored with the truth or they get it.

- On the impact of the tsunami of noise: There’s so much noise, the normal mind goes to data mining mode and takes out of the noise what it wanted to hear all along.

- All debt securities are the planned liquidation of purchasing power – He doesn’t believe long term investors should be invested in bonds.

“Great companies don’t always make great stocks to own. Sometimes expectations simply get too high and it is nearly impossible to reach that high bar” via @RyanDetrick

With so much information available to us in this internet era, it’s easy to find information that confirms what we want to believe. @cullenroche shares some interesting data to back this theory up:

“Easier access to markets and information has actually made us worse at investing.”

Arthur Zeikel’s Investing Rules via @ritholtz

NEWS & RESEARCH

S&P is becoming more cautious on corporate credit. An interesting tidbit:

“More aggressive debt-financed shareholder-friendly actions will continue to pose risks to companies’ credit quality, especially if those actions weaken or create vulnerability to their credit metrics.”

Breaking down Google’s restructuring.

Warren Buffett just made his largest purchase ever. Are we sure the market is that expensive?

The most interesting presentation I’ve heard all week:

Thanks for reading!

Sign up and receive our investing research and trading ideas in your inbox. No strings; it’s free.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.