A lot of BIG things are happening in the financial markets these days. And it’s not just confined to US markets.. it’s a global thing.

From stocks to commodities to currencies to global central banks and politics, there’s a lot going under the market’s surface.

This week’s Top Trading Links will help you stay on top of it all.

Market Technicals

JC Parets looks at the 50 best charts in the world.

Bank stocks are bouncing at crucial long term trend support – Dana Lyons

The Currency Markets have been a huge driver of markets thus far in 2016. Peter Brandt updates all the major current forex happenings.

Downside price targets for Apple (AAPL) shares – Tischendorf Letter

Chris Ciovacco makes a great point about market technicals.

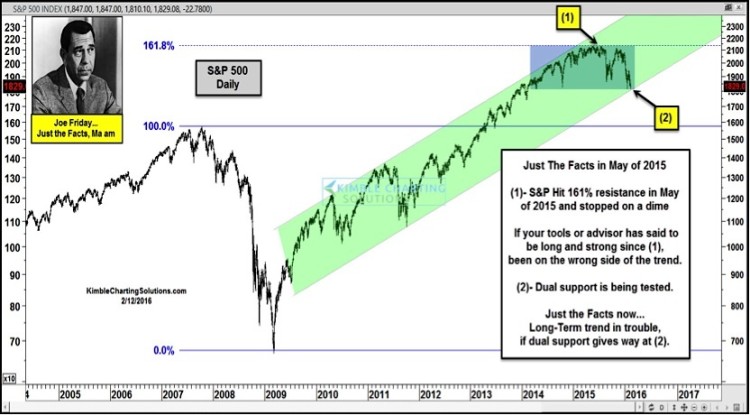

The stock market is testing a major support – Kimble Charting Solutions

The Latest COT report came out Friday. S&P 500 futures speculators are increasingly bearish – Eric Burroughs

Investor Insights

What were some signs of the top? – Howard Lindzon

A resurgence of interest has emerged in Gold – McClellan Financial Publications

A potential major positive is appearing in the global markets. The question is, is it temporary? – GavekalCapital

A look at some ETFs investors can use to reduce volatility – ETF Trends

The history of market crashes – Frank Zorrilla

Scott Krisiloff’s weekly company conference call notes.

What Japan’s negative rate policy means for investors – Daisuke Nomoto

It’s time to double down…on discipline – Richard Smith

How are 2016 Full Year Earnings shaping up? – Brian Gilmartin

News and Research

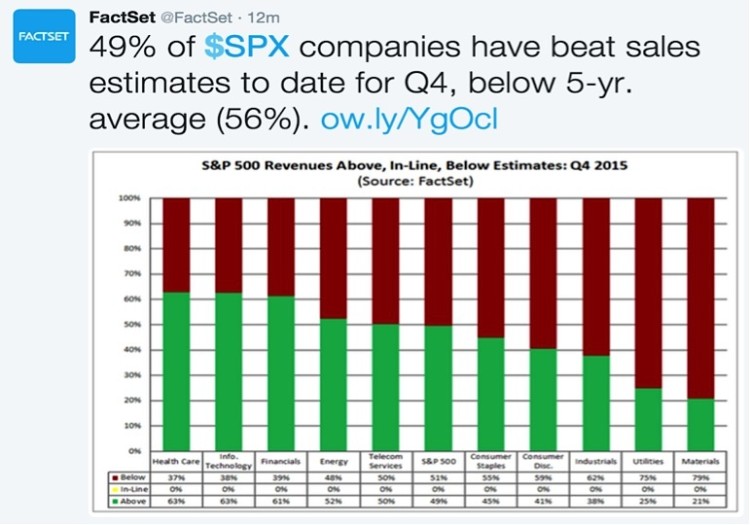

More S&P 500 companies are falling short of revenue estimates than those beating them – FactSet

The rent seeking behavior is too high – FiveThirtyEight

In case you missed it, Citron Research’s negative report on Monster Beverage.

Does media coverage affect stock prices? – Alpha Architect

The battle over CRISPR could make or break some biotech companies – FiveThirtyEight

How to read a book a week – HBR

Thanks for reading and check back next week for another edition of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.