It’s a critical time for market participants to keep an open mind. That aphorism is sage advice, to an extent. When trades and markets turn against us, we often see things we want to see and over-complicate things trying to rationalize why the markets aren’t behaving how we’d like. We still have a few weeks of earnings reports, so there will be plenty of noise.

Perspective: The S&P 500 is 1.9 percent off all-time highs.

Focus on your plan. Simplicity and discipline always wins. Trade ‘em well!

Market Insights

- A major S&P 500 fibonacci extension level is near via @andrewnyquist

Note that we saw a roughly 5% correction when the NASDAQ reached the same extension level in 2013

- The long dollar trade could be as crowded as ever via @kimblecharting

- Why the euro may be headed higher via @TradingonMark

While currency hedged ETFs are all the rage these days, GMO’s latest white paper simply explains why we should ignore that noise:

“Even if currency hedging reduces the short-term volatility of the international equity holdings, it does not reduce the volatility of the global equity portfolio because hedged equities are more correlated with U.S. equities than unhedged equities”

- Perspective is invaluable. We’ve recently witnessed the second worst commodity crash of the last 35 + years via Shortsideoflong.com.

- It’s getting to be a messy time in the global markets. It’s okay for traders and investors to say ‘I don’t know”. Here’s more on ‘I don’t know’ via @AdamHGrimes:

“The reality is that the market is a messy and noisy place, and is often very random. Things happen for unknown and unknowable reasons and the future is almost (but not quite) completely unpredictable”

- If you haven’t, be sure to check out @davebudge’s ‘old man musings’ on various market aphorisms.

- Here’s @SJosephBurns on how he trades gap ups.

Investor Insights

- @fabiancapital offers 5 suggestions for investors implementing risk management.

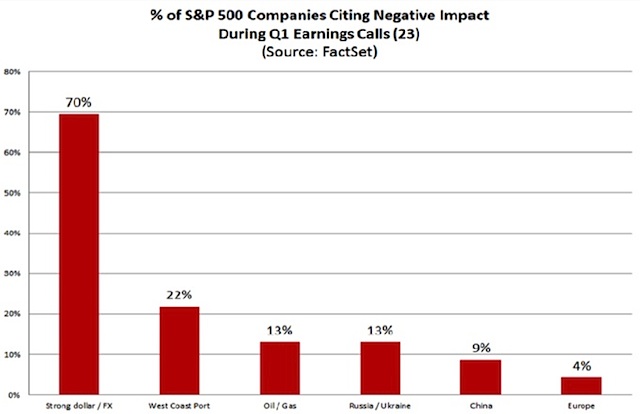

- @HumbleStudent looks towards earnings season and the impact of the rising dollar thus far.

- Mike Patton takes a look at the current market’s Shiller’s CAPE and Tobin’s Q valuations.

- @ramez digs deep into the exponential decline in energy storage costs.

- @Jesse_Livermore simulates the type of returns investors can expect if this market environment is a ‘new normal’.

Happenings

- ‘What we’re seeing is a restoration of the Senate….Committees are working productively in a way we haven’t seen in years’ – Mitch McConnell

- Small business optimism is at a 9 month low. Analysis via @AdvPerspectives.

- The Asian Development Bank’s Chief Economist shares his thoughts on various Asian economies.

- China is pulling out all the stops to awaken it’s housing market.

- German 10 year bund yields are quickly approaching 0.

Thanks for reading!

Follow Aaron on Twitter: @ATMcharts

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.