The research section in this week’s ‘Top Trading Links’ is one of my favorite lists compiled yet. Investors really need to think hard about the global economic landscape. There is a lot of pain and passive aggressive economic warfare going on across the world. Pain tends to breed either further instability and/or positive change.

So which is it? Point blank, we need to stay informed and on top of these changes to see how it all shakes out (and be prepared).

Note the iShares MSCI All World Stock Market Index ETF (ACWI) is in on the precipice of a downtrending 200 day moving average. That speaks to the emerging global uncertainty… and much of the volatility that we’ve seen of late.

Enjoy this week’s linkfest.

MARKET INSIGHTS

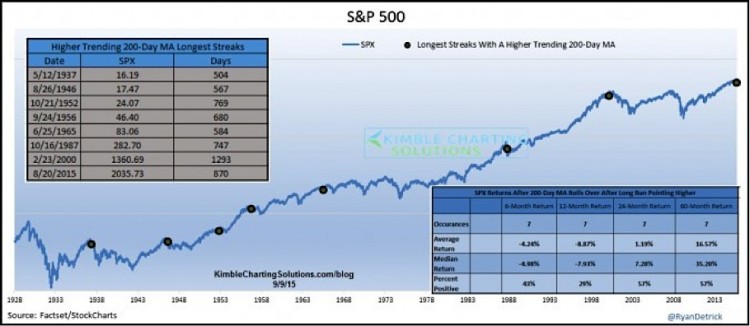

Speaking of falling 200 day moving averages….We all know the mantra ‘all the bad things in the market happen below the 200 day moving average’.

It’s true, but @RyanDetrick discusses why that doesn’t mean every drop below a downsloping 200 day is the end of the world.

@HeartCapital discusses a trend in consumer behavior that he calls the ‘stealth effect’. This passage sums it up nicely:

“At the time the wealth effect was peaking, the goal/anxiety of the parties involved was primarily retirement. As assets rose, those anxieties became suppressed and therefore spending occurred – ala the wealth effect. Let’s revisit Doug, now 17 years wiser, and despite the financial services industry trying to dictate that outliving your assets should be his primary concern, I’d care to guess Doug’s anxieties revolve more around mortality, have I traveled enough, or have I experienced enough? If Doug’s assets stagnate or even decline, do you think Doug is going to “hang in there” holding equities or buy a couple of Harley Davidson’s so he and his wife can finally make that ride to Sturgis?”

Jim Chanos sat down with Full Disclosure Radio to speak on the Chinese economy. It’s worth a listen, some of the stats discussed will blow your mind.

The broad consensus is that earnings will continue to decline through the end of the year, but will pick back up in 2016. The expected growth rate for 2016 operating earnings is absurdly optimistic. Hat Tip to @hedgopia

Tepper says earnings expectations r 2 high. No kidding. $SPX ’15 operating ests hv collapsed, but ’16 still elevated

— Paban Pandey (@hedgopia) Sep. 10 at 09:38 AM

@SJosephBurns tells us five things we need to see to be bullish on the stock markets again.

continue reading on next page…