Noise in and around the Federal Reserve decision is becoming more insufferable all the time. The consternation that builds leading into each press conference is amazing.

As active investors, we need to do EVERY thing we can to avoid that noise.

At the same time, it’s priceless to study history and understand the effect ZIRP (Zero Interest Rate Policy) has on the world, as we’re in the midst of global economic warfare.

Enjoy this weeks “Top Trading Links”. It’s jam packed with solid research to reflect on the week that was, and prepare for the week ahead.

DIGESTING THE FED

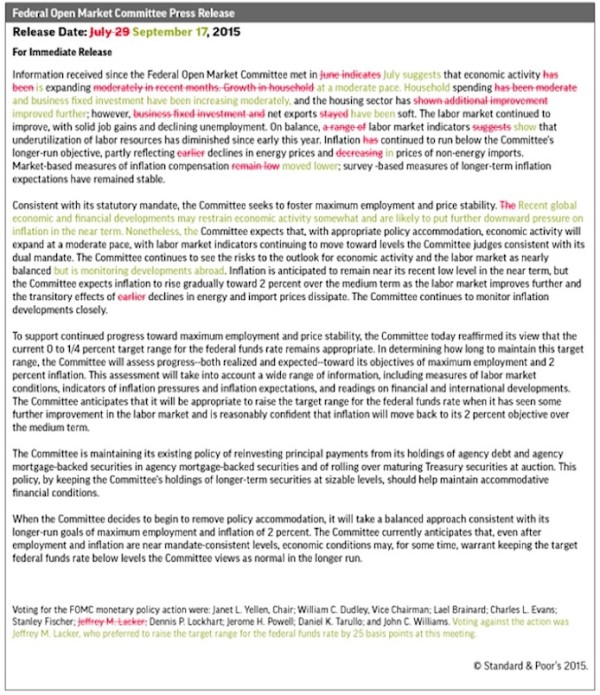

@SPCapitalIQ breaks down the changes to the Fed Statement.

5 things zero interest rate policy did for the corporate bond market via @TracyAlloway

Jeffrey Gundlach’s opinion on the lynchpin of the bond market.

A look at the Fed’s dilemma via @hedgopia

@fundamentalis looks at Fed activity over the past 25 years.

The Fed talking heads have been just that, talking heads. @michaellebowitz breaks it down.

MARKET INSIGHTS

@jessefelder notes the past two instances where the rate of change of margin debt has turned negative.

continue reading on next page…