For the week, the S&P 500 (INDEXSP:.INX) fell roughly 1 percent. That’s not all that bad considering what might have been… or perhaps, what’s to come.

On Friday, the S&P 500 briefly broke key support at 2120 before recovering and finishing at 2132. Some are classifying this as a hold of support, while others see this as technical damage. Either way you slice it, traders have a line in the sand to trade against.

If that level is breached, traders & investors will need to have a plan and follow it. This is an effective way of managing our emotions (i.e. keeping them out of our trading).

Below are some really good trading blogs with insights into the latest investing research, news, trading, and education. Enjoy.

MARKET INSIGHTS

5 reasons stocks may see more downside in October – Mark Newton

It’s an outside down week for NASDAQ ETF QQQ – Greg Schnell

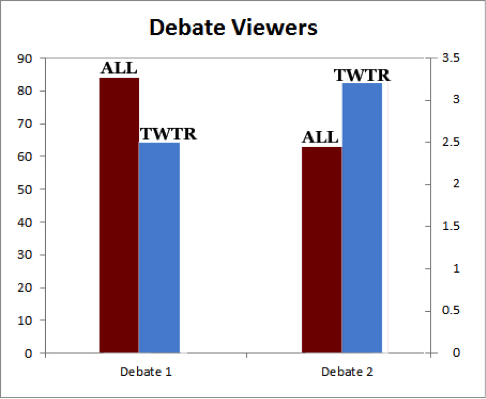

Twitter’s turnaround is working – Capital Market Labs

A great resource for company conference call notes – Avondale Asset Management

Gilead Sciences: Fundamentals vs Technicals – Fil Zucchi

TRADING INSIGHTS

How to fade TICK when trading S&P 500 futures – Tim Racette

How to avoid getting chopped up – Adam Grimes

5 things profitable traders do that unprofitable traders don’t – SMB Capital

An important question for active traders – Brett Steenbarger

Buying the Dip vs Buying the Breakout – Crosshairs Trader

Losers average losers – Dave Kelly

When to break your own rules – A Wealth of Common Sense

OTHER RESEARCH

Lessons from Cialdani’s book: Influence – 25iq

The 3 most important questions in investing – Charlie Bilello

We need to keep growing up – The Book of Life

Be sure to check back next weekend for more links to high level trading blogs and investing research. Thanks for reading “Top Trading Links”!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.