Things just aren’t as they seem, particularly in the markets. Joe Granville once said ‘if it’s obvious, it’s obviously wrong’. Short term and intermediate term price action always leads to narratives and baseless assumptions in the media that become obvious. They mostly just distract investors. Luckily, the financial blogosphere is filled with insightful folks who demystify a lot of the noise.

Let’s get after it with this week’s “Top Trading Links”.

MARKET INSIGHTS

@NoanetTrader reminds us don’t buy into the hype of lockup expirations. Like everything else, this gets priced in before the event occurs.

With another Fed statement coming and going last week, the ‘fear’ of the Fed raising rates appeared again. But why is that? It turns out, markets tend to rally during tightening cycles per @RyanDetrick

Although the market is at hovering at new highs, breadth momentum has completely deteriorated via Tom McClellan.

Back to the market pricing in everything, @ReformedBroker notes Gold tends to rise after rate hikes.

The recent China crash has been pretty scary for global investors. It’d be pretty easy to assume that action would spill over to global markets. @RyanDetrick points out the China’s price action generally stays contained.

Speaking of the China crash, it seems most are speaking of it as a past event. Is it over? @OptiontradinIQ thinks it isn’t.

Given that the financial markets are the toughest game in the world, you might think being extremely precise is the way to win. In my experience, it’s the way to lose. @TMFHousel explains why rule of thumbs work better. The same thought process can be applied.

The narrative is reality to an extent via @GestaltU:

Acts only serve to support the narrative; they have no power in themselves. The narrative is based on faith, and all new information is filtered through the prism of that faith.

Of course, the market narrative exists whether you pay attention to it or not. But when you embrace the great unknown, you’re able to disengage and observe the mania for what it is: the Jungian collective unconscious acting to manifest its own destiny.

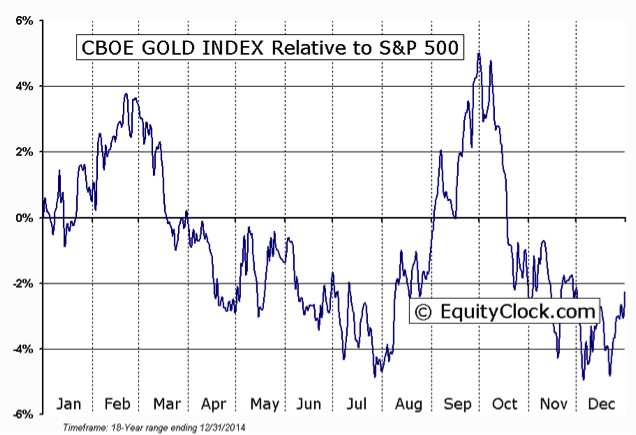

Gold has been pummelled of late. It appears this recent breakdown was a big one! Is it all over for the gold bulls? Well, maybe not. @EquityClock notes we’ve entered the seasonally strong period for gold and gold miners. At the same time, many brilliant technicians are starting to warm up to the space. It’s something worth watching in the coming weeks.

OTHER GREAT READS & RESEARCH

@scheplick mentions one of the major issues for investors in Twitter that also frequently use social media. It can be incredibly hard to notice, but most normal people don’t really use twitter. While many of us use it and love it, many people don’t have the same interests or motivations and simply don’t see the value in it.

If you’re a big Twitter user, and you’ve been long $TWTR because of that, think about the availability heuristic you’re face to face with.

— Stefan Cheplick (@scheplick) Jul. 29 at 09:53 AM

@bpeck has been the go-to guy for insights on twitter’s biz. He’s warning us a turnaround will take awhile.

US Trade is about more than the dollar.

@AndrewThrasher compiles a main list of reasons why we’re at the biggest risk of a market top in years.

You’ve probably noticed the weakness in solar stocks of late. One reason may be subsidy cuts are coming across the globe. It’s a hot topic in the UK as well.

Will Rising Home Prices lead to slowing sales? by @hedgopia

@ZorTrades talks about Brazil. Why? He shared some eye opening stats on battered country returns.

Anybody remember July 2011? by @ETFexpert

@trengriffin’s lessons learned from Paul Tudor Jones:

The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge.

One may think the godfather of behavioral finance would be doing handsomely well with his fund. He’s not. Markets are so tough:

[The fund’s performance beginning with the start of 2012] …a dollar invested in AZFAX had increased to $1.87 by June 26. A dollar invested in DFUSX would have increased to just $1.80. That’s an outperformance of about 1 percent a year.

Thanks for reading! Be sure to check out our Top Trading Links archives for a goldmine of investing research and trading education.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.