The financial markets rallied hard early last week after receiving information on polls showing that the UK would likely stay in the EU. But that proved to be misinformation (i.e. wrong). And stocks and financial markets used BREXIT to exit after the UK voted to leave the EU.

What’s so crazy is how quickly the market got complacent and simply rested on a positive (or non-news) event. Either way, many investors, traders, funds, and desks were caught off guard.

The coming days and weeks will help to clear up the technical picture for traders. Sometimes it takes a little patience to find good trading setups (long and short).

This week’s “Top Trading Links” is filled with great indicators, ideas, and insights. Enjoy!

MARKET & TRADING INSIGHTS

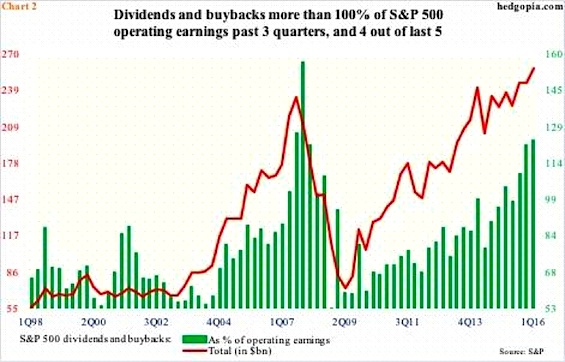

A must see earnings statistic – Paban Raj Pandey

The Trade Risk Market Recap – Evan Medeiros

Is a 2007 pattern repeating in the NYSE – Chris Kimble

Also from Chris Kimble: The German DAX is testing major support

Nervy Global Investors dust off 1930’s playbook – Mike Dolan

Cyber Security M&A is picking up – Joe Kunkle

5 things you should know in the aftermath of Brexit – Frank Zorrilla

U.S. railroad carloads are below the 2009 lows – Eric Bush

NEWS & OTHER RESEARCH

Meet Today’s American Consumer – McKinsey

How much does the president really matter? – Freakonomics

The FAA announced the first set of U.S. commercial drone regulations – Insurance Journal

How to make sense of the Brexit turmoil – Five Thirty Eight

DARPA’s new digital eye lets soldiers see around objects – Engadget

Amazon Echo really matters – Anil Dash

Facebook Live now allows two person broadcasts – TechCrunch

Thanks for reading and be sure to tune in next weekend for another round of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.