Stocks continued to grind sideways to higher throughout the week. This action was to the chagrin of market bears who are likely feeling the grind.

Statistic of the Week: The S&P 500 Index (INDEXSP:.INX) has risen just 0.5% in two weeks.

Market bulls see this as a net positive, as excess is worked off through time rather than price. And market bears are likely feeling the burn of time as a meaningful pullback couldn’t come soon enough.

Either way, the tension on the tape is real and both bulls and bears are ratcheting up the noise.

Caution is advised though, as this sort of noise can make investors chase, second guess, and capitulate. Stick to your process and follow price.

Enjoy this week’s reads, as we highlight some of the best investing research. Top Trading Links is on!

MARKET INSIGHTS

The S&P 500’s bollinger bands have gotten very tight – Mark Arbeter

Why new highs in August are rare and significant – Ryan Detrick

2200 is a big deal in the S&P 500 – James Bartelloni

How the market reacts to news – Olivier Tischendorf

“My favorite lesson that Bob Zoellner taught me is that when the stress gets so great that you think you might vomit, you should probably double your position, but only if you are then willing to use a tight stop loss on the entire position.” – Marty Schwartz

Knowing where to get out before getting in – JC Parets

Three market indicators pointing to higher prices – Willie Delwiche

Why you should study the hell out of yourself as a trader – Brett Steenbarger

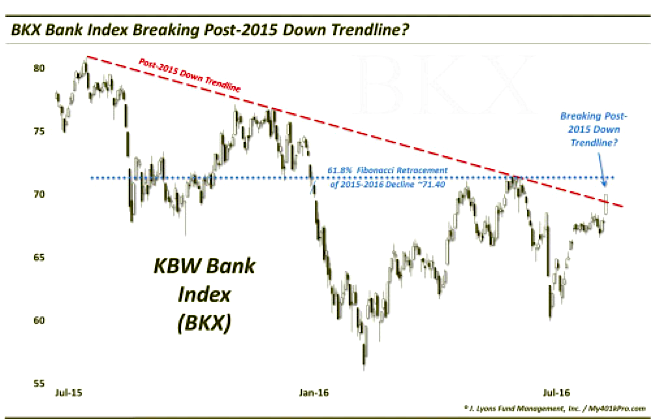

Is it time to bank on financial stocks again – Dana Lyons

Ten things hard about trading – Steve Burns

NEWS AND RESEARCH

What to do when you’ve made a bad decision – Harvard Business Review

6 secrets to true originality – McKinsey

Video: Why you think you’re right, even if you’re wrong – Julia Galef

Introspection – The book of life

Tesla autopilot drives impaired man to the hospital, saves his life – Big Think

Hillary Clinton’s cattle futures windfall – National Review

Thanks for reading!

Be sure to check back next weekend for more links to the best investing research and trading blogs. Thanks for reading “Top Trading Links”!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.