A fresh set of data points set the investing blogosphere on fire last week. Most notably margin debt. For whatever reason, new highs in margin debt were construed as bearish. Numerous See It Market contributors have debunked that market myth.

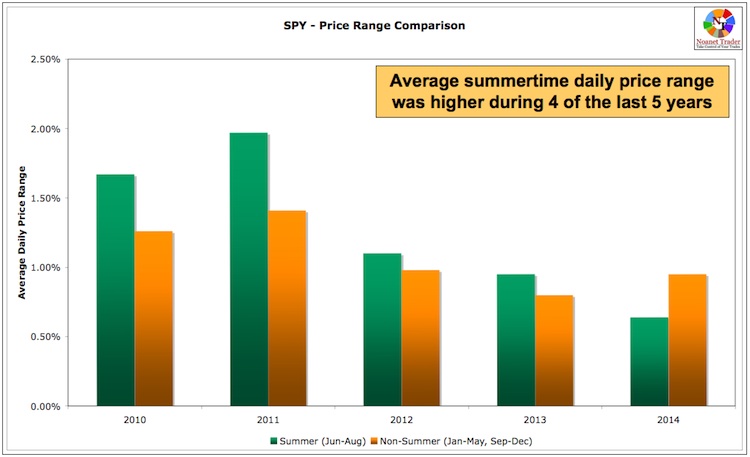

There’s also this dogma about summer trading doldrums that isn’t backed by statistics. Hopefully this week’s links serve as a reminder that accepting anything at face value is unwise, especially in the investment business.

So let’s get right to it with this week’s “Top Trading Links”.

First, On Margin Debt

@CiovaccoCapital studies the historical story of margin debt highs.

@hertcapital shared a momentum study on margin debt

Margin debt on a y-o-y basis is positive again. Rarely IT – LT market bearish. Never hooked over. $SPX pic.twitter.com/pmJNqp1OBt

— Sheldon McIntyre (@hertcapital) June 2, 2015

@RyanDetrick margin debt isn’t flashing a crash signal.

Market Insights

@NoanetTrader busts the myth of summertime trading.

Are low rates responsible for high valuations? @ukarlewitz’s research says no.

A history of the price/sales ratio via @millenial_inv

“Subsidies are the wrong policy because they are top down. It’s a centralized authority that establishes them, and then picks winners and losers. It’s also bad policy to use subsidies to create competition. In most cases, they create stronger monopolies. It’s better to deregulate, and get rid of government sponsored monopolies.” via @pointsnfigures

@hedgopia Is suppressed market volatility ready to move higher?

“The life expectancy of a Fortune 500 company in 1955 was 75 years. Today the life expectancy is just 15 years” via @ awealthofcs

@hertcapital looks at the numerous signs of waning market momentum.

The secret to changing ourselves via @steenbab

Non investing quotes offering great lessons via @ToddWenning

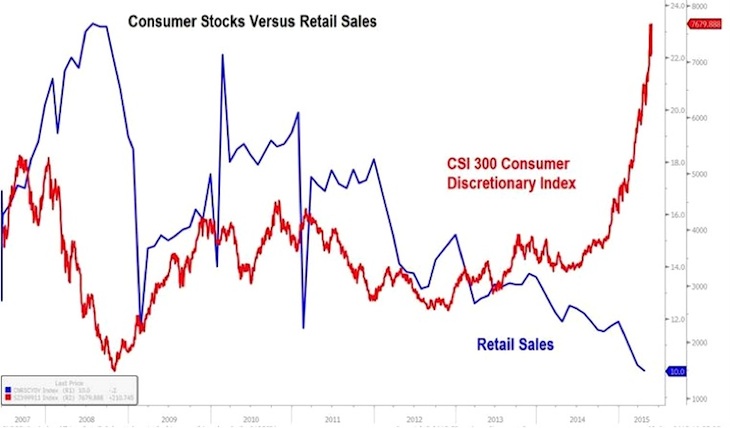

@Bloomberg shares 6 charts that show the divergence between China’s market and economy.

Happenings

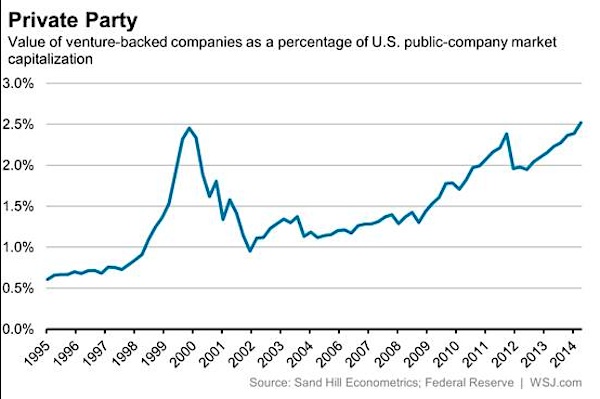

The value of Venture Capital backed companies as a percentage of public companies market cap is at highs not seen since the tech bubble.

Traders flock to volatility ETFs via @etftrends

Money is flowing out of Jim Chanos fund.

Apple is making a move into Augmented Reality.

Google Now is an ambitious project, but seemingly could be of great value to users.

Vanguard Emerging Markets ETF VWO is on it’s way to being 50% exposed to China, up from ~30% currently.

The uber bull case for Twitter via (biased stakeholder) @sacca

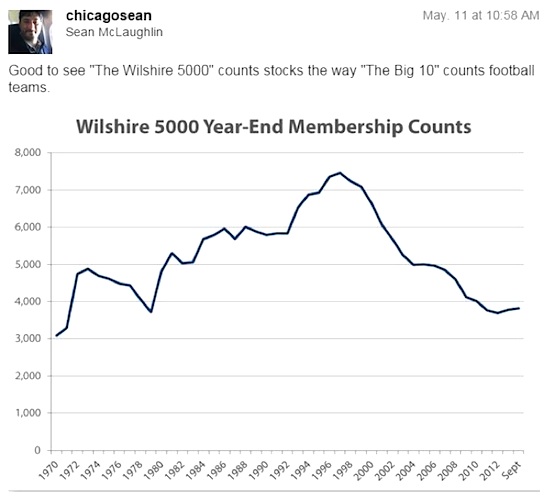

Funny share of the week via @chicagosean

Thanks for reading!

Be sure to check out our Top Trading Links archives for a goldmine of investing research and trading education.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.