What is progress? Progress in education is when you look back and you see things differently. As George Bernard Shaw said “Progress is impossible without change and those who cannot change their minds cannot change anything”.

What is progress? Progress in education is when you look back and you see things differently. As George Bernard Shaw said “Progress is impossible without change and those who cannot change their minds cannot change anything”.

To be a better market operator, you’ve got to be willing to constantly re-shape (A) how you think and (B) your thoughts. Whether it’s about how the market is acting, how the world works or every our own psychology. Note Ray Dalio for instance. A month ago he was notably bullish on China. Now, as events have unfolded and the market environment has changed, he’s willing to change his mind after taking a beating. Is there egg on his face? Only if you choose to look at it that way.

MARKET INSIGHTS

Ray Dalio on China:

”History has shown that smart investors tend to sell when the government is artificially supporting prices and buy when they are liquidating positions”.

Dana Lyons aka @JLyonsFundMgmt ran an expose on how shockingly poor market breadth is right now: ‘The thinnest new high in stock market history“.

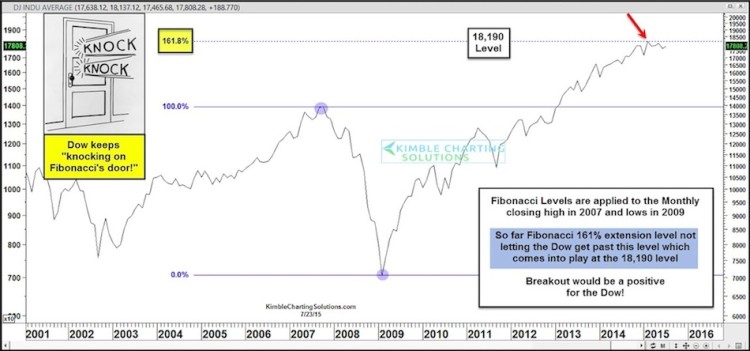

@KimbleCharting notes the key fibonacci extension in the Dow Industrials. The recent high is going to be a simple tell moving forward:

@IBDinvestors shares how to find IPO winners.

After Monday’s loss, gold miners were as oversold as any time ever on a rolling 5 day basis – via shortsideoflong.com.

Check out @TradingonMark’s Elliott Wave Analysis of oil.

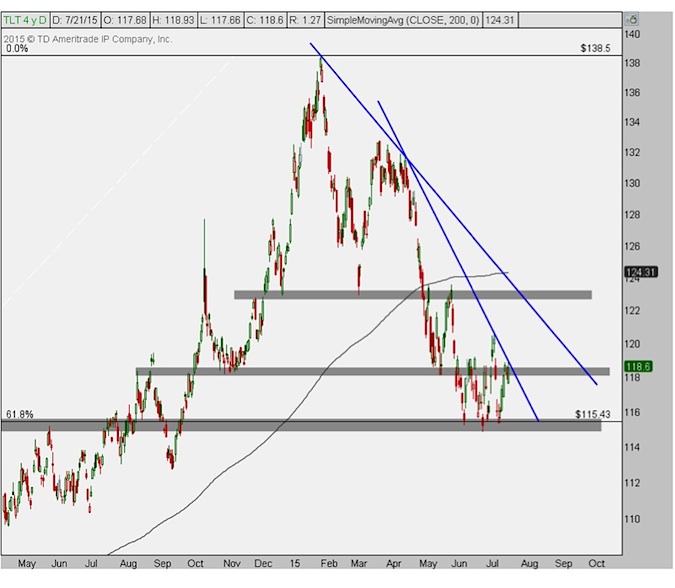

@allstarcharts on long term treasuries:

@hedgopia on corporate bond issuance.

“The excesses that took place to fund shale oil/gas projects, for instance, are coming home to roost. Energy bonds that were trading in the 60s and 70s are now trading in the 20s and 30s. All of a sudden, buyers have gone on the sidelines.”

Semiconductors have massively diverged from the market since the ‘M&A’ top in late May. Studies suggest semiconductors and PCs are the new standard by which to measure global economic health. More on this growing concern by @AndrewThrasher

OPERATOR INSIGHTS

Howard Marks on @Ritholtz Masters in Business podcast. My key notes/takeaways:

- The real success in investing goes to people who achieve a superior understanding of the things going on, why they’re going on and what they mean.

- If you think the same of everybody else, you’ll behave the same. If you behave the same as everybody else you can’t expect to out-perform.

- The first job of the money manager is to control risk.

- We can’t predict, you can prepare …you can’t prepare for everything, we have to do it probabilistically.

@farnhamstreet on decision making with commentary from Billy Beane of baseball fame:

“Sometimes, even when you have success, there’s an assumption that that success was based on your process”

Things to consider before you hit the buy button by @fabiancapital:

“However, with some simple planning and situational awareness, you can be better prepared to make proactive (rather than reactive) investment decisions.”

RESEARCH & NEWS

Homejoy shuts down after worker classification lawsuits.

Per Gartner, Mobile data growth is expected to grow at a 60% clip in 2015.

Tesla’s future is going to be awesome. Gasoline powered cars are TOAST! by @Ritholtz

“If you can’t tell when you’re wrong about something, it’s very hard to learn anything new.”

The first success in connecting flexible energy devices directly without using wires or circuits.

20 Lessons from 20 successful entrepreneurs.

We’ve heard about the recent soar in euro denominated bonds by US corporations, but nobody mentions we’re only touching 2007 levels.

Thanks for reading! Be sure to check out our Top Trading Links archives for a goldmine of investing research and trading education.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.