The market finally succumbed to some selling. However, it remains to be seen if bears can capitalize. The bulls are still the bully here… that is, until the bears can create more technical damage.

The stock market is likely trying to price in a couple of important events on the horizon:

- The upcoming Federal Reserve meeting and

- The BREXIT vote

It remains to be seen if either will matter, but the financial markets continue to trade all over the place. Utilities recent push higher has been impressive, and Gold and Crude Oil prices are battling interesting levels. We should know more soon.

This week’s “Top Trading Links” is stacked with great insights to help us navigate our way through the noise. Enjoy.

MARKET INSIGHTS

How to improve your trading – Pradeep Bonde

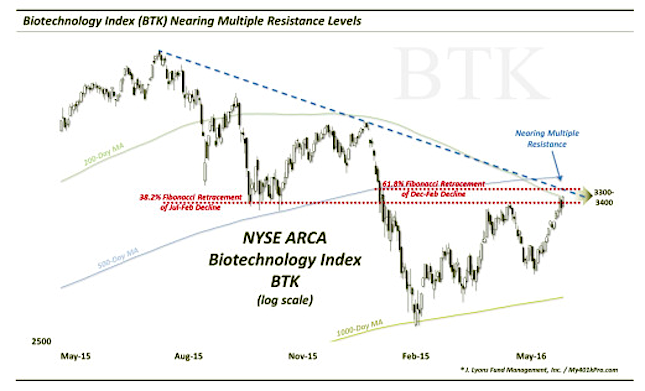

Biotech Stocks are trading at a key price level – Dana Lyons

Saudi Arabia and the oil trade – David Merkel

Utilities are overdue for a ‘major correction’ – James Bartelloni

Labor market momentum fades as hiring cools down – Willie Delwiche

Goods Deflation is good – Ed Yardeni

Tableau Software is too cheap – Joe Kunkle

Is the RBOB rally running out of gas – Tom Bruni

Video: The current state of options market indicators – Larry McMillan

NEWS & OTHER RESEARCH

Mutual Funds are NOT facing extinction – FMD Capital Management

Expect more REIT consolidation – S&P Capital IQ

The Put into Perspective letter is a great monthly read – Skenderbeg

The HTC Vive V/R headset is rolling out – VentureBeat

Larry Page is betting on flying cars – Bloomberg

Apple is making so much clean energy, it formed a new company to sell it – The Verge

Donald Trump is following a trail blazed by …Henry Ford – Priceonomics

Nothing beats bad feedback – Fast Company

Thanks for reading and be sure to tune in next weekend for another round of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.