It’s been a rather quiet market for the past 4 weeks. But just when everyone was thinking that the tight trading range would give way to a pullback, stocks rallied and closed at all-time highs.

From a macro perspective, the move is both boring and meaningful at the same time. Boring: for the week, the S&P 500 Index (INDEXSP:.INX) rose 0.4%. Meaningful: the market closed at all-time highs and may be breaking out of a tight range.

Whether we get a breakout or a fakeout, the market finally appears to be ready for some action. Remember, patience is often a traders best friend.

We have some great reads this week, so let’s dig in.

MARKET INSIGHTS

Investors (over?) trim their hedges – Dana Lyons

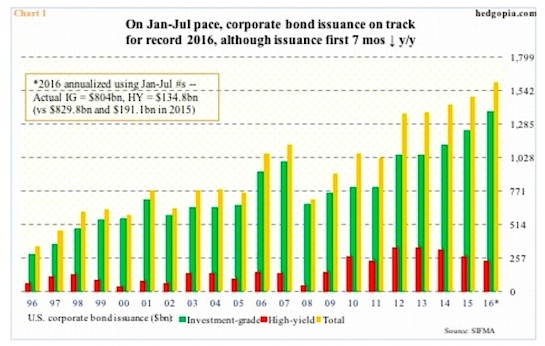

U.S. corporate bond issuance is down – 25% YoY – Paban Raj Pandey

A few things for investors to remember into the election – Jeff Voudrie

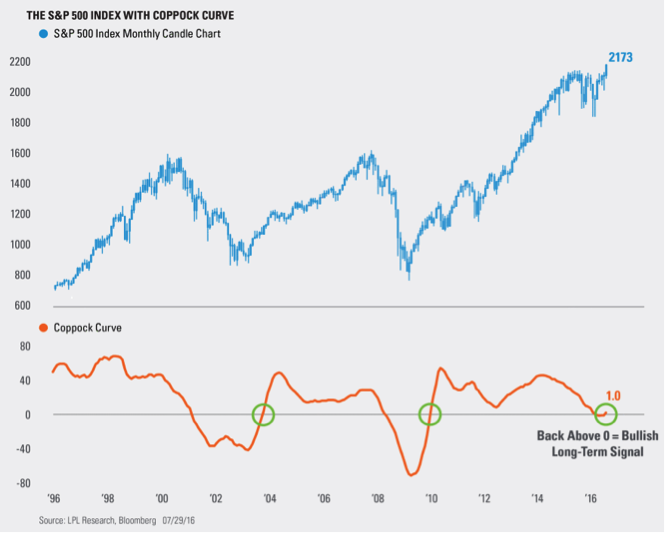

Famous Technical Indicator Triggers a long term buy for stocks – LPL Financial

A history lesson about the need for flexibility – Chris Ciovacco

Winning trades are the byproduct of losing trades – Peter Brandt

10 Jesse Livermore quotes – Joe Fahmy

There’s not much value in income generating ETFs – David Fabian

Is crude oil bottoming? – Chris Kimble

NEWS & RESEARCH

The real promise of Virtual Reality – Shira Ovide

Growth without goals – Patrick O’Shaughnessy

Bruce Lee’s notebook on willpower, emotion, reason and more – Brain Pickings

The 10 attributes of great investors – Michael Mauboussin

Two things killing your ability to focus – Harvard Business Review

Straight talk about big data – McKinsey

Thanks for reading!

Be sure to check back next weekend for more links to the best financial blogs. Thanks for reading “Top Trading Links”!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.