This week saw stocks take a hit.

Most of the damage was done on Tuesday, but by week’s end the S&P 500 Index (INDEXSP:.INX) had fallen 1.5%.

At current levels, the S&P 500 is just 3 percent off all-time highs. The question here: Is this just a run-of-the-mill 3 to 5 percent pullback? Or something worse?

Slowing momentum has pointed to divergence for several days, so this pullback isn’t unexpected. Bearish sentiment has perked up a bit (see: Twitter), but regardless, a healthy break was due.

This week’s set of links include macro research, investing trends, trading ideas, and some notable news. Read up!

MARKET & TRADING INSIGHTS

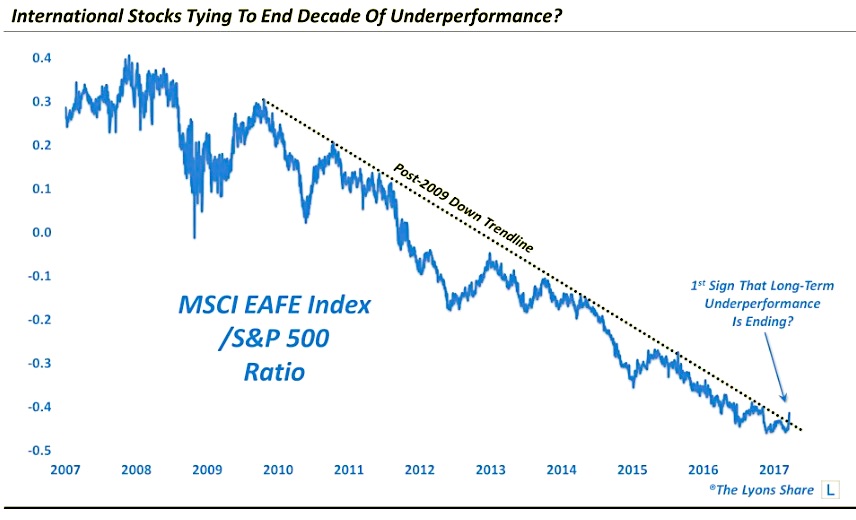

Are International Stocks finally putting an end to U.S. Dominance? – The Lyons Share

Gradual Improvements Go Unnoticed – Irrelevant Investor

Fund Manager Asset Allocation Analysis – The Fat Pitch

On Being Wrong – Crosshairs Trader

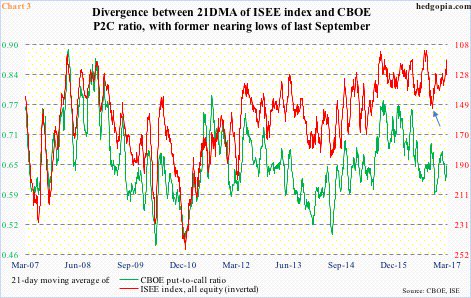

The VIX is range bound but chirping – Hedgopia

REITS, Rates and Returns – Pension Partners

NEWS & RESEARCH

The state of America’s Infrastructure – Visual Capitalist

The SEC adopts T+2 Settlements for transactions – SEC

The Art of Applied Focus – Shane Parrish

The potential China effect on the athletic wear industry – Quartz

The Power of The Invisible Hand – Vinny Lingham

Podcast: Premeditated Success – Investor’s Field Guide

Be sure to check out the latest investing and trading research right here on See It Market. Thanks for reading!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.