It was another week of twists and turns, but by and large, the S&P 500 Index (INDEXSP:.INX) is stuck in a consolidation trading range. For the week, the major stock market index ended up 1.2%.

Much of the gains came on a positive reaction to back-to-back central bank announcements (Bank of Japan and the Federal Reserve). And when the Fed did exactly what traders thought, the market cheered. But that’s the M.O. of the market vs Fed relationship.

For now, we are watching to see if stocks can see some follow through to the upside. Other risk on/off indicators like crude oil, the VIX, and gold will also be on our radars.

This week we have some excellent research to browse through. Our top trading links this week include some education, trading ideas, news, and macro market indicators. Enjoy!

MARKET INSIGHTS

How to organize yourself for everyday trading – Pradeep Bonde

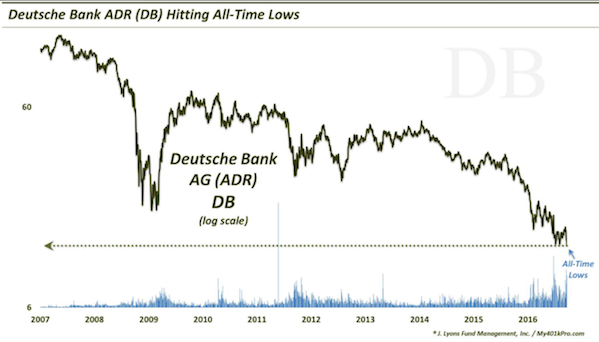

A Red Flag worth noting: European Bank stocks are struggling – Dana Lyons

There are mixed signals coming from the housing sector – Paban Pandey

Is natural gas in a massive bottom? – Peter Brandt

Long Term Treasury bonds are on verge of turning bearish – Trading On The Mark

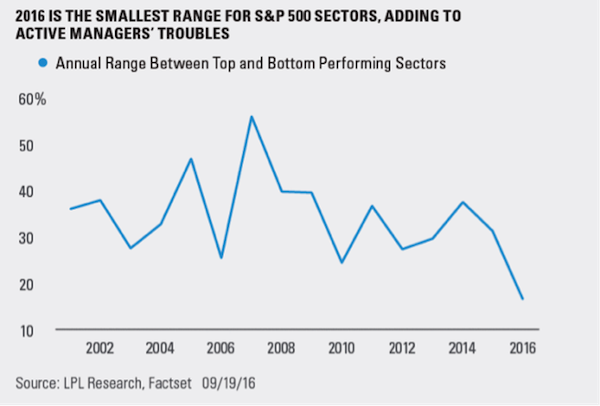

Why active managers have struggled – LPL Research

Urban Carmel was interviewed by Financial Sense

There are a few caveats to the Bullish market outlook – Mark Newton

NEWS & RESEARCH

A new growth theory – Esko Kilpi

The anti-drone arms race is taking off – Fast Company

Why the father of modern statistics didn’t believe smoking caused cancer – Priceonomics

Cities will change when cars drive themselves – Conor Sen

The science of habit forming products – Nir and Far

Be yourself while becoming yourself – Leadership Freak

Pension Funds love High Yield Bond ETFs – Lisa Abramowicz

Thanks for reading.

Be sure to check back next weekend for more links to high level trading blogs and investing research. Thanks for reading “Top Trading Links”!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.