Last week saw the stock market take a deep breath. Perhaps investors should do the same… while they can. The furious rally off the February lows finally paused, with the S&P 500 slipping 1.2% last week.

The decline comes near an important confluence of technical resistance which has market bears excited. But a one to two percent decline is nothing but healthy consolidation… until it isn’t.

Ready for earnings?

As we move into the second week of April, investors will be greeted with the kickoff of corporate earnings season, as Alcoa (AA) reports on Monday. Will earnings play a role in the market’s next big move? Could they be a catalyst?

Here’s a few things to look for on that front, along with some great trading/investing disciplines and worthwhile market news. Enjoy this week’s edition of “Top Trading Links”.

MARKET, TRADING, AND INVESTING INSIGHTS

Shameless Plug: I chatted with Stocktwits on ‘The Must Follow Podcast’

Earnings insight as we enter earnings season – FactSet

Negative EPS guidance is at a 10 year high – FactSet

Savita Subramanian’s Q1 Earnings preview – Josh Brown

Q1’s earnings growth may be the low point in the cycle – Brian Gilmartin

First quarter recap – Frank Zorrilla

The Dollar/Yen may be near a major low – James Bartelloni

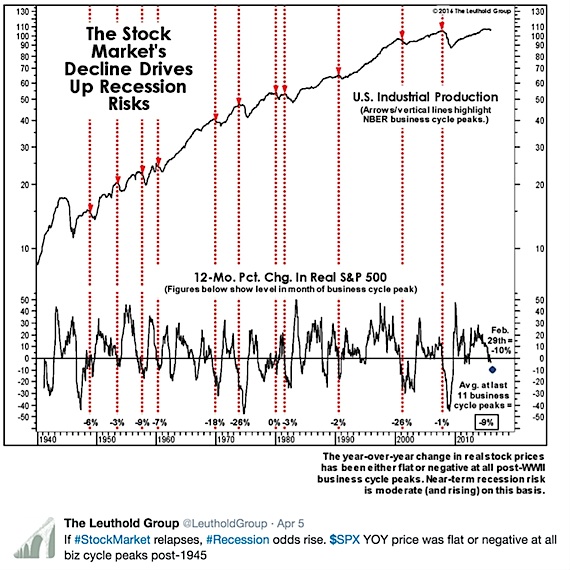

Here’s an interesting stat shared on Twitter via The Leuthold Group

Range Expansion marks the start of a new move – Pradeep Bonde

Big Money Traders are short T-Bonds – McClellan Financial Publications

Short Term Narratives vs Long Term Fundamentals – Columbia Threadneedle

An interview with Gary Antonocci – Quant Investing

Building your trading willpower – Brett Steenbarger

NEWS & RESEARCH

Startup deal funding falls to the lowest level in four years – Olivia Zaleski

Tencent’s WeChat is still in it’s infancy – Homa Zaryouni

How Amazon will kill your local grocer – Shelly Banjo

*TIP: read into this carefully* Oculus Rift Production has been temporarily halted due to a component shortage – Williams Pelegrin

Life Lessons from Famous Comedians – Ben Carlson

IBMs technology could be the key to accelerating AI advancement – David Cardinal

Thanks for reading and be sure to check back next weekend for another round of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.