Three major themes this week in the market are earnings season, Charlie Munger and the inflation trade and related debates. We’ll cover these and more in this week’s Top Trading Links.

Market Insights

- @andewnyquist makes an excellent point in his S&P 500 update:

“Why hasn’t the market collapsed under this bevy of divergences and slowing momentum? The likely answer is demand. There has been enough capital flowing into U.S. assets. Low rates of return domestically (and even more so abroad) continue to force capital out of cash reserve accounts. Since the financial crisis, other countries have tried to play catch up with QE/stimulus and this has spawned extremely low to negative interest rates in Europe and elsewhere.”

- @ukarlewtiz looks through history to measure if falling earnings alone have led to the end of bull markets.

- @kimblecharting ran a study on large reversal months in oil after a 40% decline.

also, @andrewnyquist notes we’re seeing activity in the oil market that’s consistent with that right before a major move.

- @filzucchi gives some unique reasons on why we should be cautious about biotech going forward.

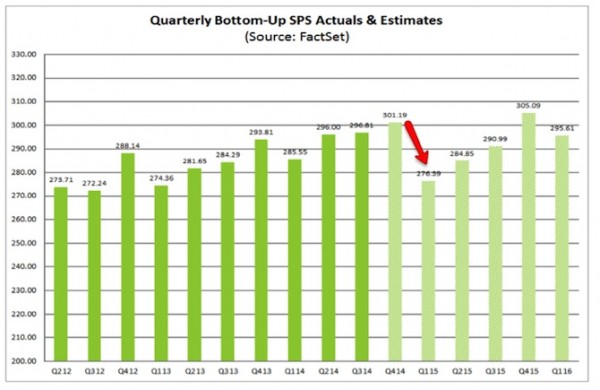

- @FactSet provides some valuable earnings insights, noting that the S&P 500 earnings are set to decline 4.6% year over year in Q1. Plus, we should probably ask, where’s the positive forward guidance?

- Geopolitics are scorching hot as tensions continuously rise and mini wars are occurring across the globe. @ritholtz talks about the impact wars play on investments.

Economics & Policy

- @chrishelman comments on the recent run of debt offerings in the energy space and explains why it’s bad for energy prices:

“As economist Ed Yardeni explained in his Monday note: “Repeat after me: Easy money is deflationary. I know that’s hard to believe since we’ve all been taught that easy money is inflationary, [but] easy money can also stimulate supply, especially in recent years because producers overestimated the ability of easy money to boost the demand for their goods and services. Easy money allows “zombie” companies to stay in business, thus boosting supply, even though they are losing money.”

- @BenBernanke is blogging these days. He and Larry Summers have gone back and forth discussing monetary policy this week and he shares his thoughts on Summer’s secular stagnation argument.

Trader Psychology

- Choppy markets like this one tend to lure us into over-trading. @AdamHGrimes discusses how to prevent that from happening:

“The first step is to realize that your job is not to trade–rather, your job is to take the best trades. Your job is to take on the right types of risk at the right time, and, sometimes, maybe for a long time, this means doing nothing.”

- @steenbab explains why we don’t perform up to our potential.

Happenings

- George Soros sees opportunity in Ukraine and offers some VERY interesting reasons as to why.

- @joshelman explains Greylock Partners investment in Meerkat. He delves into the attractiveness of streaming video.

“Instead of reading asynchronous messages, you can jump in live, with friends, to view the world through someone else’s eyes and talk and express yourself together. For artists and creators, we think this will inspire a new way of engaging with their fans and enable them to create and earn significant new value for their content along the way too.”

- @digg digs through some great minds in content to understand why audio never goes viral.

Investment research

- Lauren Cohen, Dong Lou and Christopher Malloy studied corporations manipulating information flow during earnings in hopes of hiding bad news:

“A long-short portfolio that exploits this differential firm behavior earns abnormal returns of up to 182 basis points per month, or over 21 percent per year. Further, firms that cast their calls have higher accruals leading up to the call, barely exceed/meet earnings forecasts on the call that they cast, and in the quarter directly following their casting tend to issue equity and have significantly more insider selling and stock option exercises.”

- Lazard presents why concentrated portfolios are better.

- Morningstar looks at why it’s important to invest with managers who have their own money at stake. Managers that invested no money in their funds clearly underperform those who put their own money on the line.

Much about Munger

- @valuewalk provides a transcript of Charlie Munger’s talk from the 2015 Daily Journal meeting:

“The finance industry is 5% rational people and 95% shamans and faith healers.”

- @marketfolly shares notes on Munger from the 2014 Daily Journal meeting.

- Here’s some audio of Charlie Munger’s talk at the University of Michigan in 2010:

“There’s two things I’ve learned in my long life: never feel sorry for yourself and don’t have envy, it’s the only one of the deadly sins that isn’t any fun”

- Haven’t read a lot about Munger? Check out this mega PDF file filled with some of Munger’s best speeches, quotes and appearances.

- @trengriffin delves into the most important concept Munger discusses: not being stupid.

- Warren Buffett chimes in with his current market thoughts. Notes via @LaMonicaBuzz

Check out our “Top Trading Links” archives. Thanks for reading! Enjoy the long weekend!

Follow Aaron on Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.