As investors head into the dog days of summer, they are consuming a swath of corporate earnings.

With summer upon us and the S&P 500 Index (INDEXSP:.INX) at all-time highs, are traders getting lulled to sleep? Or is it the other way around: Never short a dull market?

No doubt there is plenty of noise to contend with. But earnings have been coming in at a pretty good clip and perhaps its a better backdrop for stock picking (or focused trading/investing).

We have a lot of great research and insightful articles this week. Without further adieu, here is “Top Trading Links”.

MARKET INSIGHTS

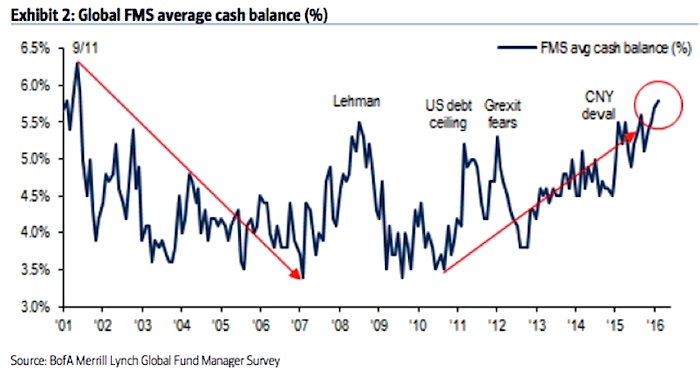

Fund Managers Current Asset Allocation – Urban Carmel

The global debt crisis – Chris Ciovacco

A look at the Nikkei 225 into next week’s BoJ meeting – Jason Leach

Investors have been pouring money into major emerging market bond funds – Daily Wealth

Did the S&P 500 just enter a new bull market? – LPL Research

Is a low VIX sending a warning? – Paban Raj Pandey

The most important element to trading – Steve Burns

Smart Money is positioning for a rotation into financials – Joe Kunkle

Higher oil prices trigger supply increase – Shane Obata

NEWS & RESEARCH

Beware of 13F Institutional Ownership data – Wesley Gray

Three steps to get up to speed on any subject quickly – Nir & Far

Three Insightful Concepts from ‘The One Thing’ – Ivaylo Ivanov

How to be productive – Barking up the Wrong Tree

Podcast: How to be less terrible at predicting the future – Freakonomics

The four tools of discipline – Farnham Street

Be sure to check back next weekend for another edition of Top Trading Links. Thanks for reading!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.