It’s hard to look ahead to 2016 when December finds the markets on shaky ground. But even traders need to understand the macro environment to be prepared for the what’s happening, or what may happen.

2016 is right around the corner and although some themes are beginning to emerge, one theme remains the same: uncertainty about the market’s next move. Well that may be helped once we see the Fed raise rates and get a feel for how the market digests that action. That process may begin as early as next week!

Enjoy this week’s compilation of research and insights for “Top Trading Links”.

MARKET INSIGHTS

MUST READ of the week: RW Baird’s 2016 market outlook from @WillieDelwiche

Howard Marks says there are now a lot of opportunities in distressed debt markets. – @Bloomberg

Did you know: New highs vs new lows declined for two years into the 2000 NASDAQ peak. – @CiovaccoCapital

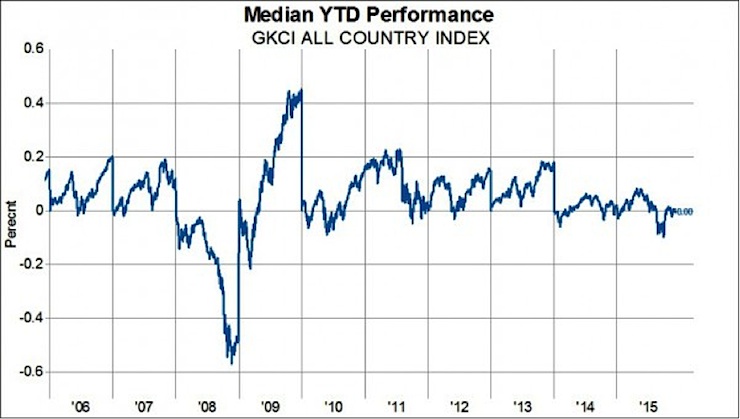

The median stock in the world is flat year to date – @ValueWalk

Atlassian is the most attractive stock to come public in a while. Look into it and keep an eye on it – story via @dealbook

Is a double top forming in the S&P 500? – @kimblecharting

@BartsCharts notes The NYSE is testing a key support area

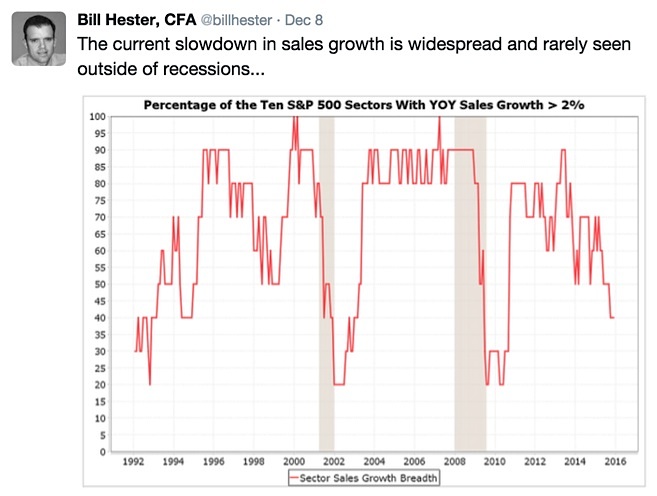

@billhester notes sales slowdowns this widespread usually signal recessions.

The 10 best charts in the world via @allstarcharts

You want a black swan? Here’s your black swan via @zerohedge

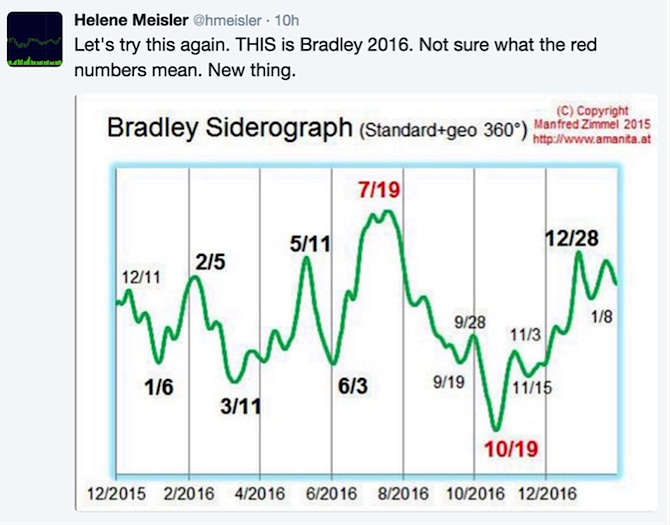

Is financial astrology a load of BS? Probably, but it’s still a fun and interesting topic. @hmeisler shared the 2016 Bradley Siderograph. More on the Siderograph

Tuesday was an inflection point in the Bradley Siderograph @TradingOnMark

continue reading on the next page…