Stocks had another volatile week. You wouldn’t know it by seeing the final numbers: S&P 500 Index (+0.3%).

In reality, stocks opened higher last Monday reaching as high as 2071 before 2025 on Thursday. But a late week kick-save by the bulls kept the market churning.

The S&P 500 is still just 4 percent off its all-time highs. That said, there’s never been a more intense battle between bulls and bears over where/when the next move is coming.

Here are some great reads by top market analysts and bloggers to help paint a better picture of what’s going on. Let’s dig in – below is this week’s “Top Trading Links”.

MARKET INSIGHTS

Apple is set up to bounce in this low 90s area – Tom Bruni

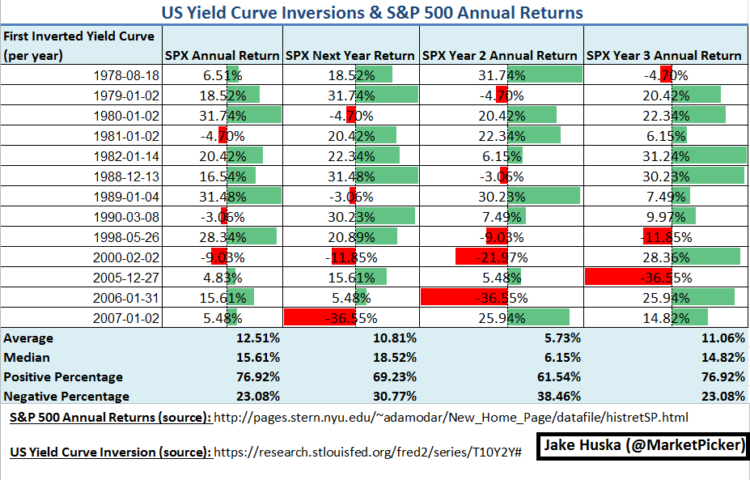

Is the Yield Curve flashing a sell signal for stocks – Jake Huska

Silver is hitting triple resistance – Chris Kimble

The Volatility Cycle – Charlie Bilello

A look at the May BAML Asset Allocation Survey – Urban Carmel

ETF stats for April – Invest with an Edge

Investors are paying historically high multiples for sales – Eric Bush

Four things to watch in the S&P 500 – Greg Harmon

OTHER NEWS & RESEARCH

Google’s newest patent is an adhesive coating for cars – Futurism

Elevate yourself with side projects – Slack

See through wood makes for a cool headline, but it has no utility at this point. – Engadget

Everything as a service – Ben Thompson

Chinese investors have piled into U.S. tech companies the last couple of years – CB Insights

It’s your brain’s fault you keep making the same mistakes over and over – Big Think

When making any life altering decision, give yourself 30 days to think on it – Brad Feld

The Big 5 for a longer life and better health – James Altucher

Thanks for reading! Check back next weekend for another round of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.