The stock market grinded to new highs while pessimism rose. And that made for a bullish combination. For example, we see plenty of breadth divergences are creating doubt. Frankly, we can all see what we want to see in market breadth at this point. If you missed it, be sure to check out last week’s read from @ukarlewitz on the fruitlessness of market timing using breadth divergences. Maybe they will matter, but they are just one piece of a puzzle filled with several bullish pieces.

With that, lets dig in to this week’s Top Trading Links.

Market Insights

- @MWellerFX and the team over at forex.com compiled an awesome trading research piece with key notes on the popular currency pairs.

- @PeterLBrandt digs deep on Crude Oil. Have we just seen a long-term bottom?

- @kimblecharting looks at the big level in the Dow Jones Industrials relative to Gold ratio.

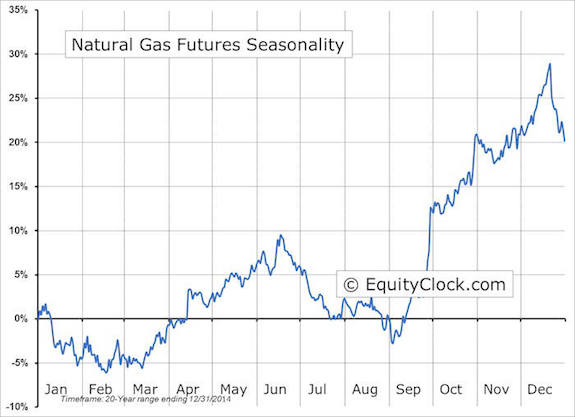

- @allstartcharts notes several great reasons why he is bullish natural gas. Last week, @tradingonmark mentioned a completed downside elliott wave pattern as well.

Trading Insights

- @manualofideas scored this exclusive interview with Howard Marks on sustaining success in the markets. It’s a fast listen with some great thinking points.

- @zortrades reminds us there’s tons of ways to make money, but it’s best to find a way that works for you and stick with it.

- @smbcapital explains the importance of context, particularly in short-term trading. Multi-time-frame analysis is a must regardless of your time-frame.

- @financetrends put together an awesome piece for traders struggling to pull the trigger. It’s pretty much a consensus that smaller position size can help us get over that hump.

Bookmarks

- @EddyElfenbein shares the story of Jesse Livermore and looks into his psychological make-up. We all have our psychological issues to work through, maybe reading this will help you better understand a behavioral trait that hurts your trading!

- @mjmauboussin co-authored this long research read on the psychological attitudes investors need to have. This paper will convince us we all have some conflicting beliefs to work through.

- @SJosephBurns offers a list of top technical trading rules.

- This rolling one month forward earnings calendar is pretty neat Keep in mind most companies don’t announce earnings dates until 2-3 weeks before.

Thanks for reading! Have a great rest of the weekend!

Follow Aaron on Twitter: @ATMcharts