The market was relentless in its pursuit of a higher prices this week. After a sharp decline the week prior, the bulls came in at key price support and pushed prices sharply higher.

Though the market is due for some consolidation very short-term, next week is a short week and tends to be bullish seasonally. Volume will be light so traders will need to stay focused. And lastly, in light of the global terror attacks, traders will want to be nimble.

Without further adieu, here is this week’s “Top Trading Links”. Enjoy!

MARKET INSIGHTS

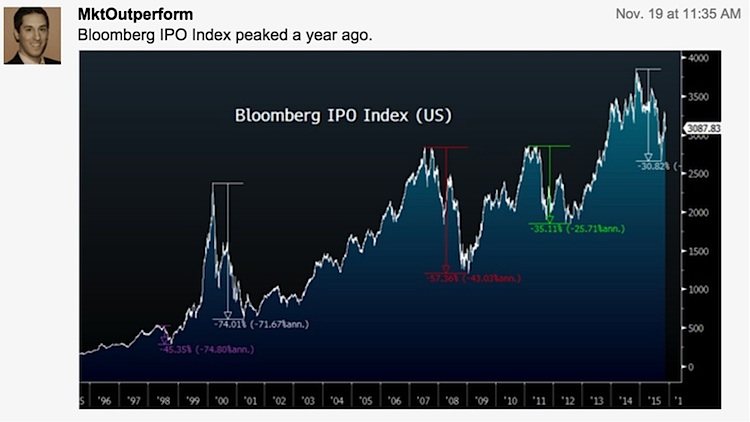

This article by @awealthofcs explains why popular IPOs of the last couple of years have generally performed so poorly. Are the private markets too crowded?

To that point, @MktOutperform notes the Bloomberg IPO index peaked in q3 2014.

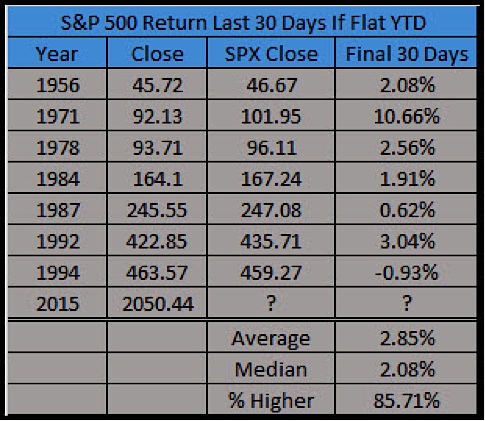

The popular S&P 500 analog these days is 2011. Probably because it happened recently and the data is readily available. @jessefelder looks into another interesting, possibly more relevant analog.

@KimbleCharting looks at the Santa Claus rally

Goldman Sachs on how companies expect to spend their cash in 2016 – via @ValueWalk

@millennial_inv compares volatility of returns of value stocks vs growth stocks – ‘value wins again for consistency….glamour has the more fun and exciting outliers, but the median glamour stock gets killed’

The Fed has tried to appease the markets for nearly 20 years. @MktOutperform explains why.

continue reading on the next page…