After failing to show up for investors in 2016, Santa Claus finally made his arrival. Stocks hit the ground running this week, with the S&P 500 (INDEXSP:.INX) ending its first full week up 1.8%.

So everything is sunny and looking up, right? Not quite.

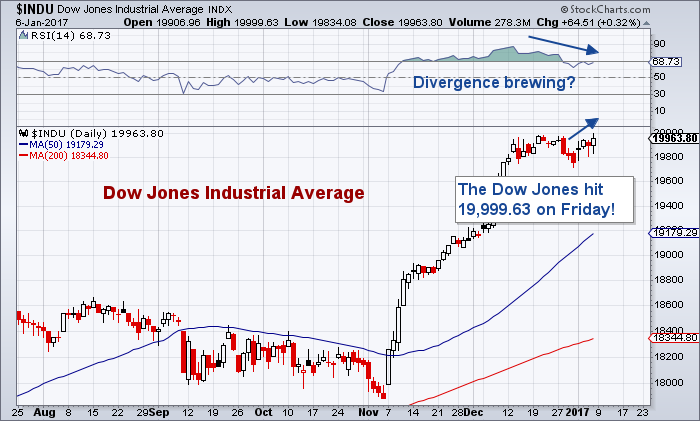

The market still faces the same challenges: overly bullish sentiment, divergences, and a rally that may not have gotten enough rest (see Dow Jones). This could lead to a short-lived rally… or even a false breakout.

As I’ve pointed to several times recently, big round numbers tend to be psychological barriers. So, although Dow Jones 20K will likely be broken soon (it hit 19,999 on Friday!), it may be hard for the first breakout to “stick”.

Now for some investing research blogs, insights, and ideas. We have an excellent set of reads this week. Enjoy.

MARKET & TRADING INSIGHTS

50 things I learned about the markets in 2016 – Stefan Cheplick

Could Gold Bugs outperform the S&P for years to come – Kimble Charting Solutions

Finding the next Amazon – Irrelevant Investor

When do you average down? – Bronte Capital

3 ways to improve waiting for trades – The Trading Coach

Using the Metals markets to forecast interest rates – Andrew Thrasher

Byron Wien’s market surprises for 2017 – Blackstone

NEWS & RESEARCH

2016 new drug approvals fall to a 6 year low – Reuters

Quantum Computers are ready to jump out of the lab – Nature

Mozart’s Brain and the Fighter Pilot – Farnham Street

What can we expect in China in 2017 – McKinsey

Maintaining Motivation – Adam H Grimes

Watch: Two Google Homes argue – Gizmodo

Check back every weekend for more links to some great investing research blogs and trading ideas. Thanks for reading!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.