Make it 5 weeks in a row. Whoa! The bulls have been in stampede mode and are just now starting to puff their chests out.

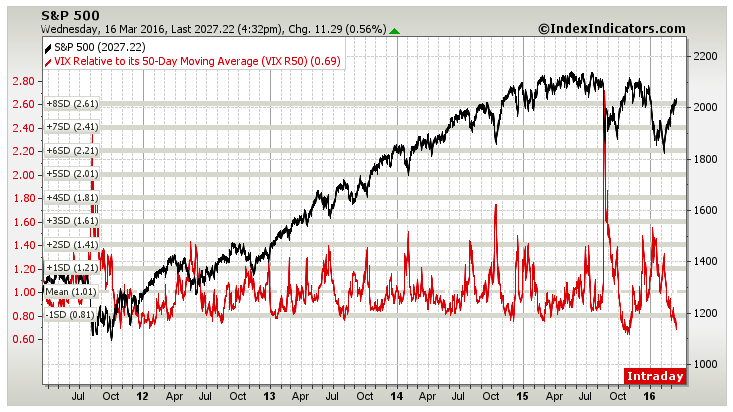

Perhaps for good reason. Crude oil has rallied back above $40 while the VIX has sank to new lows in 2016.

But this may be reason for near-term caution. It appears that the easiest part of this leg higher is behind us. Will the “Ides of March” bring some volatility back into the markets? Or will the rally run straight into April with seasonality patterns.

Let’s look across the blogosphere and see what some of the best at their craft have to share. There’s some great research and ideas in this week’s “Top Trading Links”. Enjoy!

Market Insights and Analysis

Is the VIX signaling a return of market volatility? – Andrew Thrasher

Market participants’ psychology into the Fed meeting – Greg Harmon

How the wealth effect could reverse – Jesse Felder

What usually happens during quadruple witching season – Tom Bowley

“I broke the past 15 months into two charts rather than one so the periods would be more easily identifiable. But they clearly show that the tendency has been for the stock market to reverse course at or near quad witching day. Given the strength of the rally in equity prices over the past five weeks and the longer-term ambiguity, it probably makes sense to protect profits on the long side while perhaps becoming more aggressive on the short side, depending on your preference.”

After 50 trading days in 2016, 7 things stand out – LPL Financial Research

10 Great Trading Principles – Steve Burns

Cisco shares look ready to outperform in the months ahead – James Bartelloni

Why buying cheap stocks can be deadly – Porter Stansberry

How Short Term Traders use catalysts – Steve Spencer

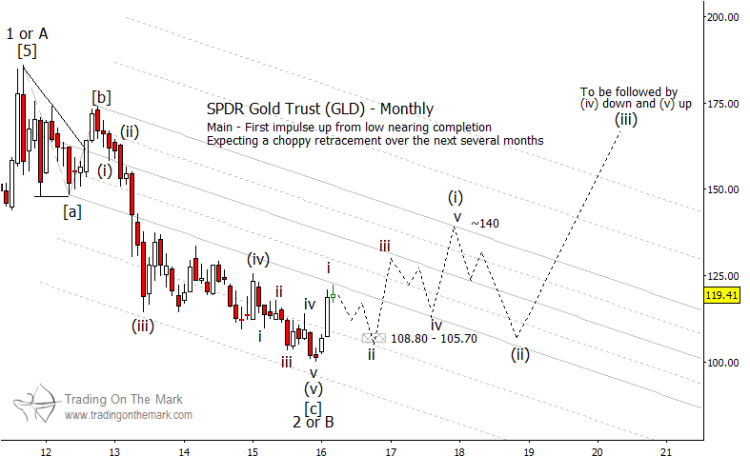

The next few years look bright for gold – Tom Pizzuti & Kurt Hulse

News and Research

Pension Partners’ Charles H. Dow Award winning research paper

A solution to the GAAP vs non-GAAP debate – Brian Gilmartin

Analyzing Facebook, Apple and the best tech companies in the world – Ophir Gottlieb

How inflation Impacts your retirement planning – BlackRock

Words from Steve Jobs on his deathbed via Mark Minervini

They’re onto your clickbait – Jonas Ellison

5 great trading books you may have missed – Sal Cilella

Steve Wozniak did a reddit AMA. He discussed his favorite tech gadgets and ideas.

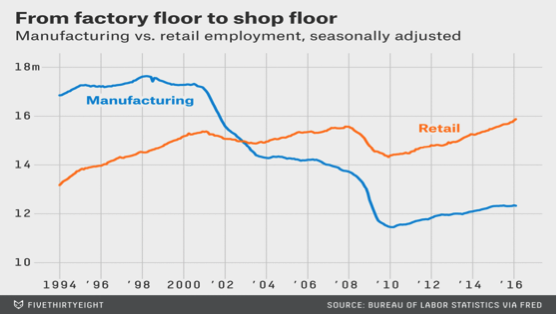

Manufacturing Jobs are never coming back – Ben Casselman

Thanks for reading and be sure to check back next weekend for another round of “Top Trading Links”.

Further reading from Aaron: “Are Select Technology ETFs Just Fads?“

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.