The stock market suffered another setback last week. But the funny thing is, it felt worse than it was. The S&P 500 slipped just 0.5% on the week but traded well off its highs by week’s close. And this puts the bulls in a tough situation this week.

So it’s only natural to wonder if the bears will be able to “break” the bulls this week.

Lots of good research out there. Hope you enjoy this week’s “Top Trading Links”.

MARKET INSIGHTS

Deteriorating breadth weakens the rally – Pradeep Bonde

The volatility curve suggests increased volatility in Q2 – Paban Raj Pandey

The oil stocks rally is in jeopardy – Dana Lyons

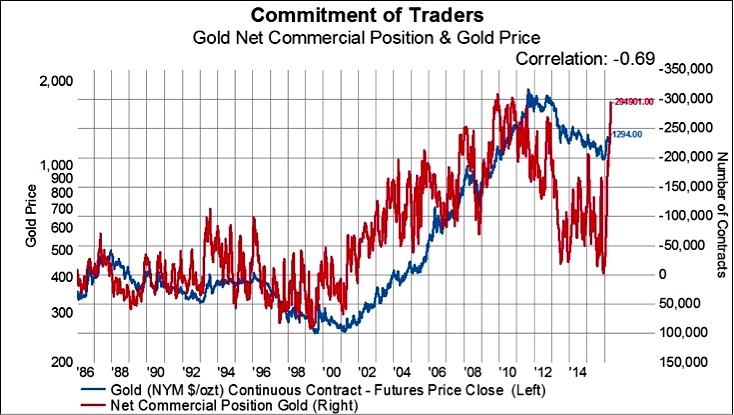

Commercial Traders are very short Gold and Silver – Eric Bush

Avondale Asset Management’s latest company notes digest – Scott Krisiloff

The Aussie dollar is setup for a big decline – Trading on the Mark

The next market to break, might not be stocks – Eric Swarts

Soybeans are on breakout watch – Mitchell Warren

Happiness precedes trading success – Mike Bellafiore

“In the stock market, one learns how important it is to act swiftly” – Tren Griffin

When mediocre trumps brilliance – Ben Carlson

OTHER NEWS & RESEARCH

The Hidden Truth about prescription drug spending – Columbia Threadneedle

The pursuit of knowledge is a crutch, take action – Sure Dividend

Higher wages are a boon for workers – Willie Delwiche

China’s government continues to do all it can to produce positive market outcomes – Ed Yardeni

The difference between love and tolerance – Brain Pickings

Thanks for reading! Check back next weekend for another round of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.