Top Trading Links – March 18

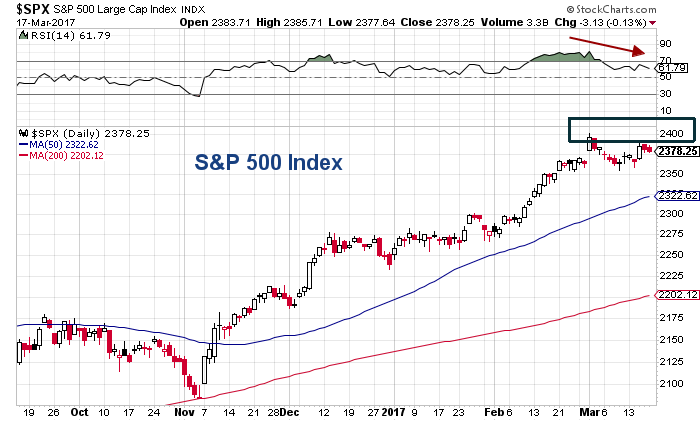

It was a choppy week for U.S. equities, as the S&P 500 (INDEXSP:.INX) bounced around on the Fed before settling up +0.25%.

But as the U.S. stock market tries to continue higher, it may contend with a glaring RSI divergence (if we see new highs in prices, but not new highs in RSI/Momentum).

Ultimately, this could lead to a pullback. No, this doesn’t mean a major top or a call for a 15-20 percent decline. Only price will dictate that… and price should be what leads investors to their risk management decisions.

That said, it was a busy week for news. Investors received a rate hike, a typical amount of “noise” about the president, along with options expiration. The rest of the month tends to be seasonality strong, followed by weakness late in the month into early April. But not all years are created equal.

Enjoy this week’s investing research and trading links. There are some great reads.

MARKET INSIGHTS

What happens to Bond Prices when the Fed Hikes – LPL Research

The Case for Investing In Indian Equities – Latticework

A Magnificently Perilous Alteration In Thinking – Zenolytics (H/T @ChicagoSean)

48 Lessons From Howard Marks on Investing – Safal Niveshak

A Look at the U.S. Pension Situation – Pension Pulse

What Do 5 Recent Market Leaders Have in Common? – Ivanhoff Capital

NEWS & RESEARCH

The Best Exercise To Improve Brain Function – Psyblog

What Trump’s budget says about his priorities – Five Thirty Eight

How China’s Capital Curbs may be Paying Off – Bloomberg

Here’s How To Stay Focused – Nir & Far

Credit Scores are are about to rise for millions of people – LifeHacker

50 ways healthy, happy, successful people live on their own terms – Thrive Global

Check back for more great research here on See It Market throughout the week. Thanks for reading!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.