June has been a volatile month. Last week we saw the VIX Volatility Index spike higher, though simmering down into week’s end. That said, stocks held up fairly well. Adding to the uncertainty is an undecided (undetermined?) Federal Reserve and the upcoming BREXIT referendum vote.

Well, BREXIT week is finally here so it should be a noisy week (ugh).

That said, it will be nice to put it in the review, as not all events are efficiently priced in. As Mike Zaccardi pointed out, implied volatility on British Pound is skyrocketing.

This week we have some great research and insights to help active investors see the market at different angles. There are still several great setups and markets that deserve attention.

Enjoy this week’s BREXIT edition of “Top Trading Links”.

MARKET & TRADING INSIGHTS

A look at the polls and markets into the BREXIT vote – Chris Ciovacco

Google is trying to crush Tesla and Apple – Capital Market Labs

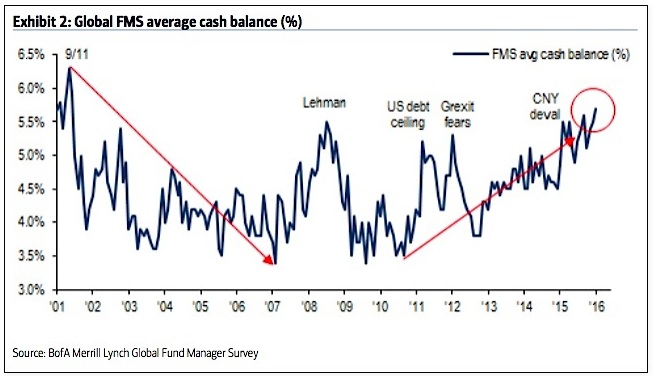

The Latest BAML Fund Manager Allocation Survey – Urban Carmel

Why Latin America has room to grow – BlackRock

Is a credit crisis coming? The bond market says no – Fil Zucchi

Two Amazon derivative plays that are ready to fly – Frank Zorrilla

Will the four drags on S&P 500 earnings start to diminish? – Brian Gilmartin

Institutional Investors are delusional – Meb Faber

There is no impossible in markets – Charlie Bilello

NEWS & OTHER RESEARCH

CRISPR may not be all it’s hyped up to be – Jocelyn Kaiser

The History of Glass-Steagall – Josh Brown

Everything Apple announced at its developer conference – Wired

Video: Marc Andreessen at the Bloomberg Tech Conference

The shift to a cashless society is snowballing – Jeff Desjardins

IBM looks to reinvent itself – again – Barb Darrow

Thanks for reading and be sure to tune in next weekend for another round of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.