Passers by probably thought it was a quiet week for the market. Heck the broader stock market as measured by the S&P 500 was basically unchanged. But under the surface, the currency and bond markets were rattled by Mr. Draghi and small caps struggled to keep up.

Traders are left to wait and see if there are any reverberations on the horizon… and, of course, if Santa shows up with positive seasonality for stocks this year.

Let’s get after it. Here’s this week’s edition of “Top Trading Links”.

MARKET INSIGHTS

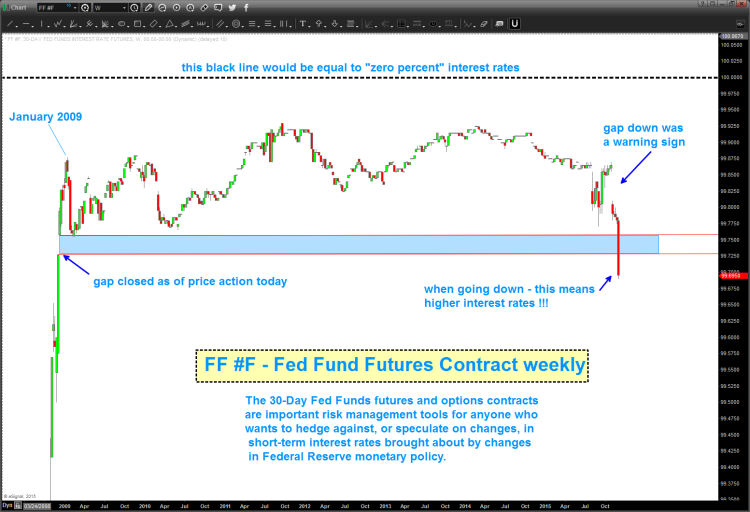

We’re seeing plenty of strong moves and options activity in interest rate related plays. Be sure to check out @WallStJesus on Twitter for more details. @BartsCharts points out that the market is speaking loudly about rates ahead of the next fed meeting.

@KastelCapital discusses intermarket analysis and the current trends in the major markets.

@skrisiloff shares how small cap corporations see the current MACRO environment.

McOscillator.com see a key turning point in gold sentiment.

@MarkArbeter thinks there is potential for a deep correction in treasuries in 2016.

@mpgtrader looks at yearly pivot points in major market reversals.

‘A strong first day of December is a very good sign’ – @RyanDetrick on December stock market performance.

@michaellebowitz continues his deep dive into stock buybacks.

MARKET OPERATOR INSIGHTS

Gatis Roze of @stockchartscom summarized his trading course lessons.

101 ETF investing tips via @ETFReference

“Don’t fret about what you can’t control” – @ZorTrades

continue reading on the next page…