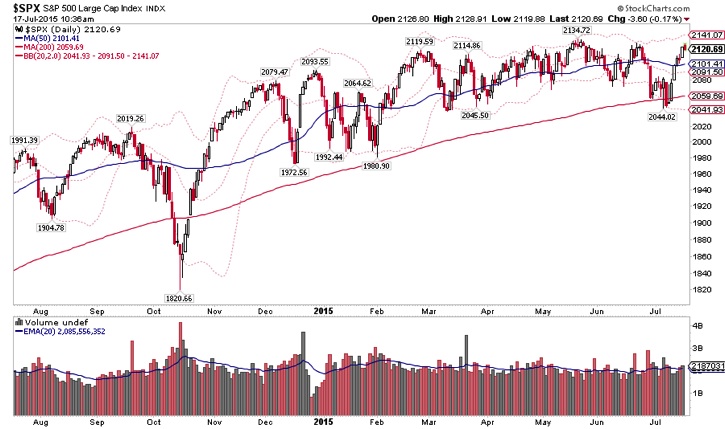

The market proved this week there is an inherent advantage to those who can adapt quickly to changing conditions. We’ve seen two of the main things bulls want to see: Strong price thrust and sentiment remaining negative or muted. Amazingly, the NAAIM exposure index actually dropped this week.

On the flip side, market breadth is still pretty mediocre, but we’ll get to that shortly. First let’s take a quick look at the S&P 500.

Prices have once again found key resistance. Decision time: an immediate breakout or a rejection? Let’s dig into this week’s “Top Trading Links”.

MARKETS

From @JLyonsFundMgmt:

ICYMI>ChOTD-7/16/15 The Junkie Market: Too Many Highs AND Lows? $SPY Post: https://t.co/p80ByqQ6eu pic.twitter.com/tcu0ayUzZN

— Dana Lyons (@JLyonsFundMgmt) July 16, 2015

@ukarlewitz dives into the messy manager asset allocation picture.

@FZucchi shares some very bearish developments in the energy space. What really stands out to me is the DeMark analysis.

@jessefelder notes that equal weight and high beta funds have lagged the recent market rally. For the time being, If you’re going to buy, buy the big names that are working like Disney (DIS), Amazon (AMZN), Netflix (NFLX), Facebook (FB), Nike (NKE) etc.

High-beta and equal-weight $SPY are calling bulls*** on this rally: pic.twitter.com/jqfETvEy8s — Jesse Felder (@jessefelder) July 16, 2015

Apparently, Dr. Copper earned his degree from Corinthian Colleges.

Via @ToddSullivan:

“The next time you hear someone say that oil, copper or some other commodity is ‘predicting something’, just ignore it.”

@RefordmedBroker notes Blackrock has seen flows out of passive funds into more active ones. It’s only one data point, but could be a sign of changing investor attitudes.

@harmongreg is watching for a reversal in the Transports.

Don’t know what a scheming perma bear looks like? Check this out via @mjohnsto.

MARKET OPERATIONS

@PeterLBrandt sits down in the most recent @stocktwits Must Follow podcast. Some key takeaways:

- “Risk management is the single most important thing in trading… and the hardest thing to learn”

- “Good traders have found the edge and exploit the edge”

- ‘You cannot mirror another trader’…this is due to drawdown periods. You won’t know how to handle them like the trader does.

- ‘You trade small you win big, you trade big you lose big’

- The hardest trade to manage is the immediate winner. When do you get out?

- At some point you just have to commit yourself to a process and stop tinkering with your strategy.

- Successful traders tend to strive for excellence and aren’t offended by losses.

- ‘A trading account is not a good way to measure one’s self worth’

- ‘If I spend enough time looking at a screen, i’ll make dumb mistakes’

How we think is so important to how we approach markets and our lives in general. @TMFHousel compiled a great read to stir up some thoughts that might change some perceptions.

Keep this thought handy, closed-mindedness is a pain:

“The very foundation of science is to keep the door open to doubt. Precisely because we keep questioning everything, especially our own premises, we are always ready to improve our knowledge.” – Carlo Rovelli

@jfahmy shared this interesting Paul Tudor Jones passage:

“..I think it’s no coincidence that our greatest champions, our greatest artists, our greatest leaders, our greatest everything all seem to have experienced some kind of gut-wrenching loss. I think their greatness, in part, was fashioned on the crucible of that defeat. “

We find our success by leveraging our distinctive strengths via @steenbab.

@ZorTrades explains why it pays to wait shorting hot new issues.

From @crosshairtrader:

“Few can any longer correlate clear vision with decisive action.”. $STUDY pic.twitter.com/mf4raNCZac

— David Blair (@crosshairtrader) July 17, 2015

Although not particularly about trading. @asymmetricinfo shares a wonderful insight. Beware of evidence you really, really wanted to find.

@sspencer_smb shares how to trade a ‘runaway’ stock.

NEWS & HAPPENINGS

Walter Energy has filed for bankruptcy. Who saw this coming four years ago? Here’s the chart from 2008-2011. It was pretty much all systems go. I’m a big believer in technicals, but there’s no denying we can’t predict the future with a chart and in the long term fundamentals drive prices.

- Intel is slashing their budget.

- An in depth look at California’s drought.

- Amazon’s Prime Day was highly criticized, but Amazon was pleased.

- Tesla is really betting on improved battery tech.

- Robots have passed the self awareness test! ..At least they aren’t evil.

- Auto sales are staying strong via @hedgopia

FUNNY OF THE WEEK:

That feeling when your positions are much larger than they should be:

Thanks for reading! Be sure to check out our Top Trading Links archives for a goldmine of investing research and trading education.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.