Stocks defied sentiment yet again to rise for the 4th straight week. And next week, the S&P 500 Index will attempt to break through major resistance around 2030-2040.

Big question now is whether or not the stock market rally is in need of a healthy break after rising over 200 points (+10%) in a month.

Price is the final arbiter so investors will need to dig into the current construct and indicators.

But there is so much more than just equities to look at across the financial markets. Commodities have made a major comeback, and currency markets have had to absorb an onslaught of central bank activity.

We have a great list of reads with this week’s “Top Trading Links”. Dig in and enjoy.

MARKET INSIGHTS

Stocks are battling weak fundamentals – Chris Ciovacco

Why Natural Gas could rally 40% – Tom Bruni

Is a big rally coming in Coffee? – James Bartelloni

A look at industry group performance year to date – Eric Bush

A renko chart look at the S&P 500 – Greg Harmon

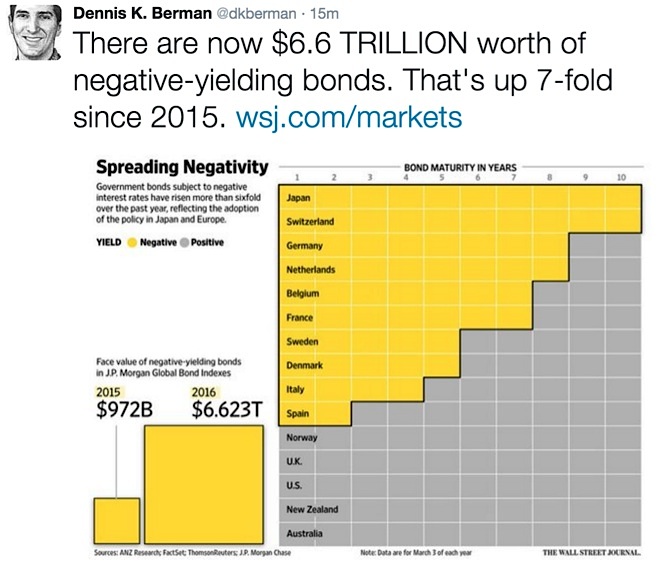

What are the consequences of all these negative yielding bonds? – Dennis Berman

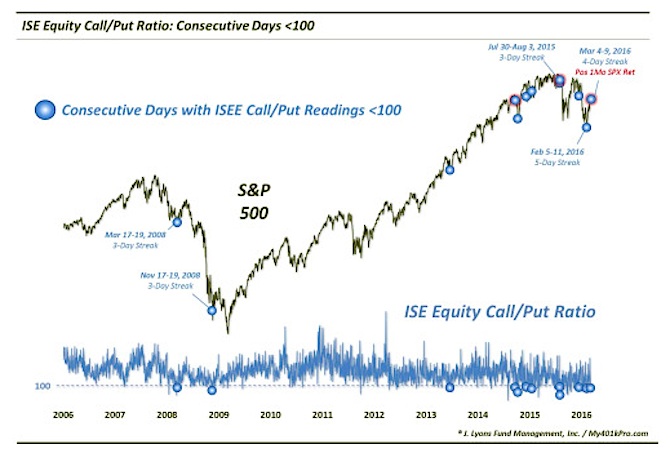

A Statistical Review of a Stock Options Indicator – Dana Lyons

The Fed has Slack – Ed Yardeni

INVESTING INSIGHTS

How to be wrong as an investor – Ben Carlson

Has the value investing pain trade ended? – Wesley Gray

Why Gold could climb 20% in the next year – Brett Eversole

Why you should drop politics from your portfolio – David Fabian

Are we due for a recession? – Michael Batnick

A look at the Canadian housing market – Shane Obata

NEWS & RESEARCH

Analyst Commentary on Virtual Reality – Tiernan Ray

A review of Amazon’s Echo – Farhad Manjoo

Check out BMW’s ‘Vision Next 100’ concept. – Top Gear

5 ways to begin a productive day before you get out of bed – Jacqueline Whitmore

Are there more levels to physics that we just don’t understand yet? – Futurism

Skyscrapers of the Future will be held together with glue – New Scientist

Deep Mind’s CEO on how AI will shape the future – Sam Byford

Thanks for reading and be sure to check back in next weekend for another round of “Top Trading Links” and update on the global financial markets.

Further reading from Aaron: “Will Commodity ETFs Be The Comeback Story Of 2016?“

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.