You know that college football game where the underdog hangs with the highly ranked opponent until midway through the third quarter before the better team physically overpowers them and pulls away? That’s what this market feels like. Bulls are just running the ball and taking the fight out of the bears. Interestingly the tone of the blogosphere hasn’t been so positive.

Lots of great investing research and trading ideas in this week’s “Top Trading Links”. Have at it.

Market Insights

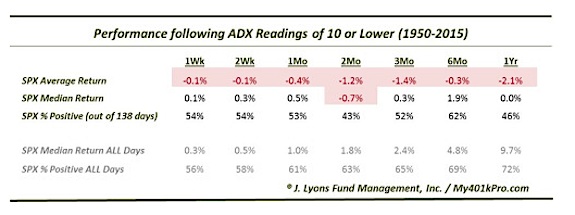

The market is trendless, is a big move coming? via @JLyonsFundMgmt. Returns moving forward are quite unattractive on average.

The stock market is off to its worst start of year 3 of the presidential cycle since 1950 via @andrewnyquist

What drives the stock market via @ritholtz

Retail sales suggest a recession is underway via @MishGEA

The Fed’s own survey shows spending sentiment is weak. The data shows how weak. Amusingly, the Fed says “consumer sentiment remains high”

Are unemployment claims nearing an inflection point? via @hedgopia

@skrisiloff puts on a clinic in his weekly company notes posts.

“Not only are there more skilled players than ever looking to uncover sources of alpha, but there are also far fewer stocks to choose from, at least in U.S. markets” via @awealthofcs

Gold Miner ETFs might be breaking out via @kimblecharting

Apple’s stock in for a big move via @OptionstradinIQ

Why investors shouldn’t worry if Greece exits the Eurozone via @MktwHulbert

iMFdirect explains the lack of corporate investment in Latin America.

“lower commodity export prices account for almost the entire decline in average investment-to-capital ratios”

Operator Insights

“For many traders, the need to be right is at least as strong as the drive to make money” via @AdamHGrimes

Finding the limitations in your investment process via @awealthofcs

Via @PeterLBrandt ”Most traders obsess over win rate, bet size and the payout ratio. Yet, they do not comprehend one of the most important variables of all — random probability theory”

It’s hard to invest based on economic forecasts via @Dull_Investing (paywall)

Happenings

Thanks for reading!

Follow Aaron on Twitter: @ATMcharts

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.