The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

We’re in the midst of the fourth quarter earnings season and already we’re seeing a cautionary set up for 2023 as corporations find ways to cut back. Higher inflation and interest rates have helped raise revenues for some, but are cutting into the bottom-line. For some that has meant widespread layoffs and restructuring plans. As companies strive to conserve cash, we see three other corporate events that will be top of mind this year:

1. Buybacks

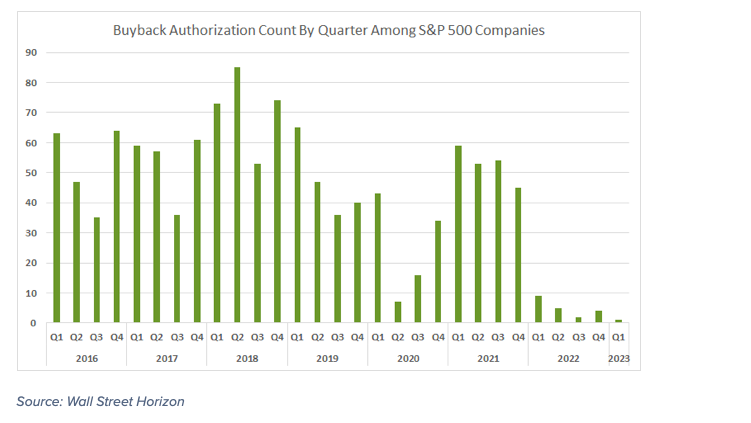

While a record number of authorizations in 2021 set 2022 up for a record number of repurchases, that tapered off in the back half of the year as companies attempted to conserve cash in the face of economic uncertainty. In 2022, only 20 S&P 500 companies announced buyback plans vs. the 5-year average of 161 (not including tender offers or open-ended plans). Buyback end dates for 2023 total 17 thus far (through January 31) vs. the 5-year average of 87, and only Costco Wholesale has announced a repurchase plan this year (with an end date of Jan 31, 2027).

Keep in mind this is not referring to the total dollar amount of repurchases, which hit a record in Q1 2022 of $281B (and then fell in each subsequent quarter), but rather the number of S&P 500 companies announcing buybacks as well as end-dates.

In addition to the need to conserve cash, companies are also shying away from buybacks as a result of the Inflation Reduction Act. President Biden signed the IRA into law on August 16, enabling a 1% excise tax on corporate net share repurchases. “The buyback tax” aims to penalize companies for engaging in this type of shareholder accretive activity. This is a well known tactic for companies looking to inflate their earnings per share, buying back stock reduces the shares outstanding (denominator of the equation), artificially inflating EPS.

Note that the data counts used in the chart below represent events of S&P 500 constituents—it does not measure the dollar value of share repurchase authorizations or executions.

If buybacks are getting more expensive with the newly passed IRA, will other methods to reward shareholders replace them? Let’s look at dividends.

2. Dividends

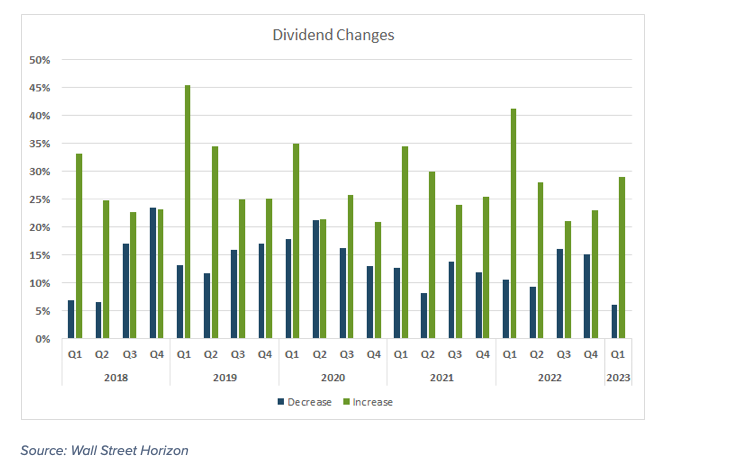

In the latter half of 2022 the number of companies announcing dividend decreases began to rise temporarily, before reverting to the mean. In total, 14,139 dividends were announced in 2022 (from the companies in our global universe of 9,500 equities), the highest amount since 2019. Of those, 12.4% were decreases, 29.1% increases and 58.5% unchanged. The 5-year average is 13.7% decreases, 28.7% increases and 57.6% unchanged, respectively.

Year-to-date (through January 31, 2023), 721 dividends have been announced. Of those, only 6% announced decreases, 29% are increases, and a far larger portion remain unchanged at 66% (vs. the 5-year historical average of 58%). Despite the flurry of economic headwinds faced by corporations this year, it’s positive to see many are holding firm on their dividend payments, and a historically low percentage are decreasing those payments as of the first month of 2023.

3. M&A

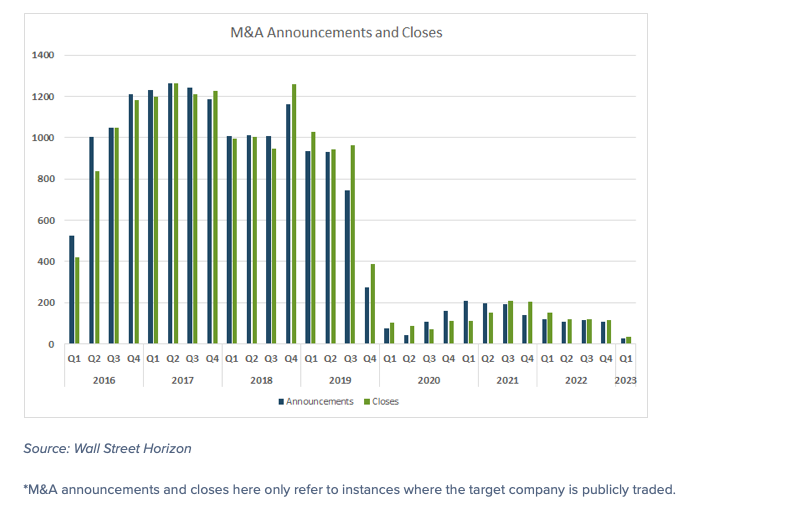

We also saw a lack of dealmaking in 2022, with only 445 deals closing vs. 738 in 2021 and a 5-year average of 1800*. There are some early signs that could be changing, with big deals made in the last two months including Amgen’s acquisition of Horizon Therapeutics and Microsoft’s 4% stake in London Stock Exchange as well as plans to invest $10B in ChatGPT creator OpenAI.

As companies build up corporate cash, CFOs are looking for new places to allocate it. They have learned to adapt and find less costly work-arounds for M&A deals that don’t always involve an investment bank’s participation, as well as ways to avoid market volatility. When will dealmaking return exactly? First companies want to understand what’s up next from the Fed to see how rate changes could affect the investing landscape throughout 2023.

So far in 2023, 24 announcements have been made in Q1 and 34 M&A deals have closed.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.