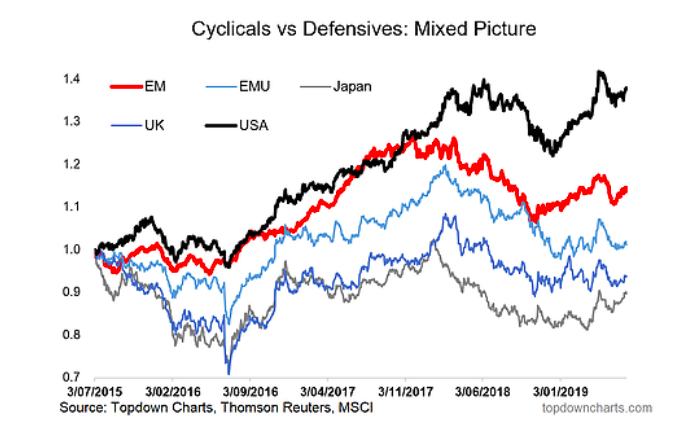

4. Global Cyclicals vs Defensives (continued)

EM cyclicals vs defensives rolled over first in late 2017, and then were also the first to bottom in late 2018. That nascent uptrend there is probably the main thing keeping me constructive on risk assets on a tactical basis, and I think is as good as anything when it comes to a tactical risk management indicator (i.e. if that uptrend breaks down, then forget about it!).

“Global cyclicals vs defensives – a key theme in 2018 with rotation well underway. But the key one here (EM again!) is the red line and the nascent rebound: watch closely for follow-through. Since initially publishing this chart in the end of year report we’ve actually started to see the other regions begin to turn up too (…just like how EM rolled over first).”

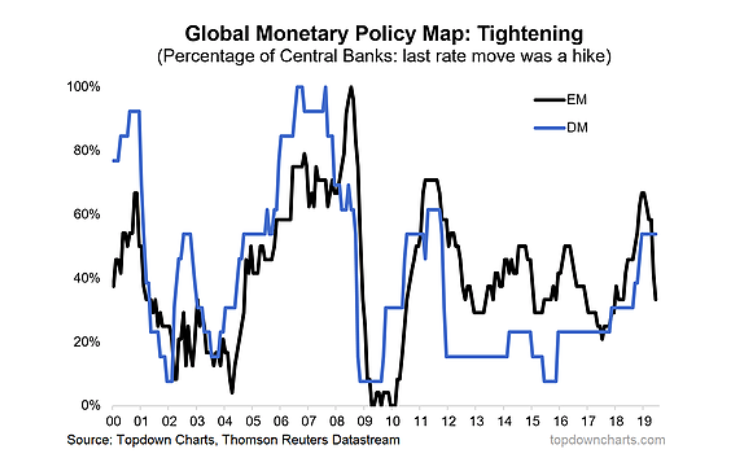

5. Global Monetary Policy Trends: The global monetary policy pivot is well underway now, this chart shows it quite dramatically with EM making a sharp about-face from a majority in tightening mode, to now a majority in easing mode. I quipped that monetary policy was in the process of going from suppressor to source of volatility, and so we come to perhaps the biggest question for the rest of the year and beyond: will (can?) central banks and monetary policy go back to becoming a suppressor of volatility?

“More and more global central banks are shifting into tightening mode. My guess is we’ll see more of the same here and more of monetary policy being a source (vs suppressor) of volatility.”

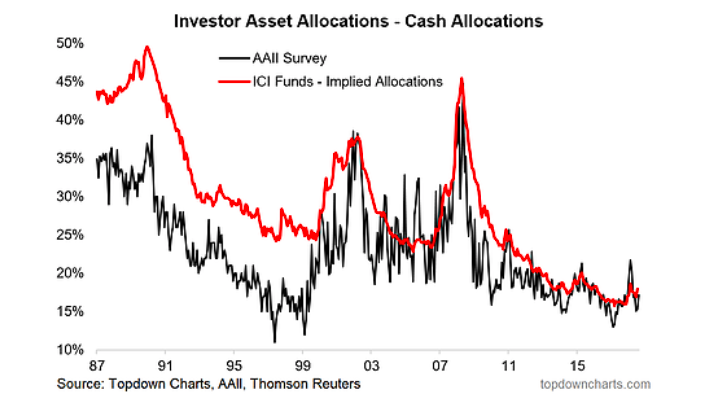

6. Cash Allocations: With the Fed likely to cut interest rates soon, cash (from a yield perspective) is still trash (but not from a capital preservation function perspective!!).

Cash allocations are clearly up from the lows, and perhaps this is the start of a cycle of rising cash allocations, but then again, if central banks faced with the risk of recession renew their ‘war on cash’ efforts, it could be back to cycle/record lows here.

“One impact of monetary policy tightening is that cash becomes incrementally more attractive (as an income generating asset) beyond its core role of capital preservation. Look for cash allocations to rise from record lows (as indeed, they have already started to do so).”

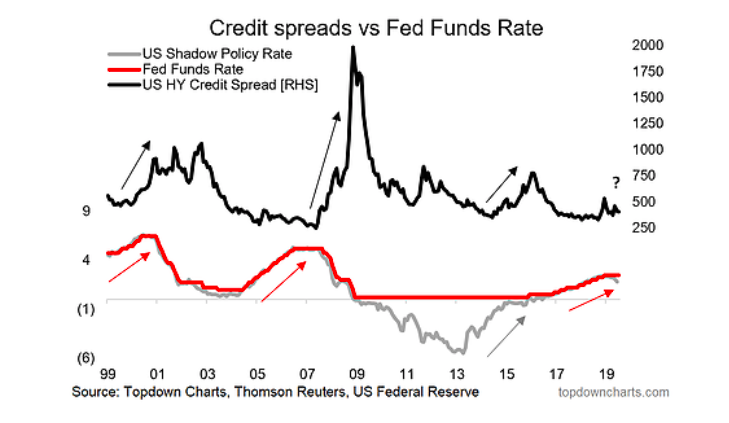

7. US High Yield Credit: Now that the Fed has basically told us they are pivoting from tightening to easing (already they tapered quantitative tightening and are set to cut rates in the near term), it only leaves more question marks here.

We are indeed in the final innings for credit/cycle, but the big question for credit really is just as simple as this: “can the Fed help avoid a recession?” If the answer is yes, then credit does well because basically credit only really gets taken out when a recession drives up defaults.

“Higher cash rates may cause issues for those who opted to push risk for income: US high yield credit is in the final innings; anticipate wider spreads ahead.”

8. Global Equity Valuations: Interestingly enough, on global equity valuations, the median forward PE is still trading below the long term average.

continue reading on the next page…