Many investors have had a rough year. 2022 has been characterized by turbulence in financial markets.

The Nasdaq, S&P 500, and Russell 2000 are all in bear market territory, while the Dow Jones is the only U.S. index down less than 10% YTD.

The performance of U.S. indices year to date paints a grim picture: Nasdaq (QQQ) -33%, IWM (-23%), SPY (-20%), and DIA (−9%).

Returns for investors range from smaller profits to substantial losses depending most likely on whether passive or active strategies are deployed and whether any funds are allocated towards alternative assets – like commodities.

Rigorous analysis and a trading plan are crucial to trading successfully in bear markets. Commodities are volatile, and it is essential to have stops and profit targets for commodity trades.

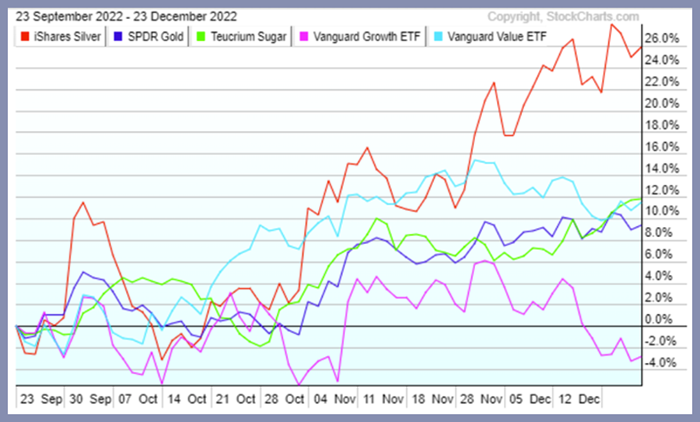

The chart further below displays the performance of Silver (SLV) 26%, Sugar (CANE) 12%, the Vanguard Value ETF (VTV) 11%, Gold (GLD) 9%, and the Vanguard Growth ETF (-3%) over the last 90 days.

The S&P 500 began declining in early January and officially entered a bear market on June 13, 2022.

Inflation, higher interest rates, and increased geopolitical tensions all contribute to persistent concerns in the present bear market and will continue in 2023.

At a glance

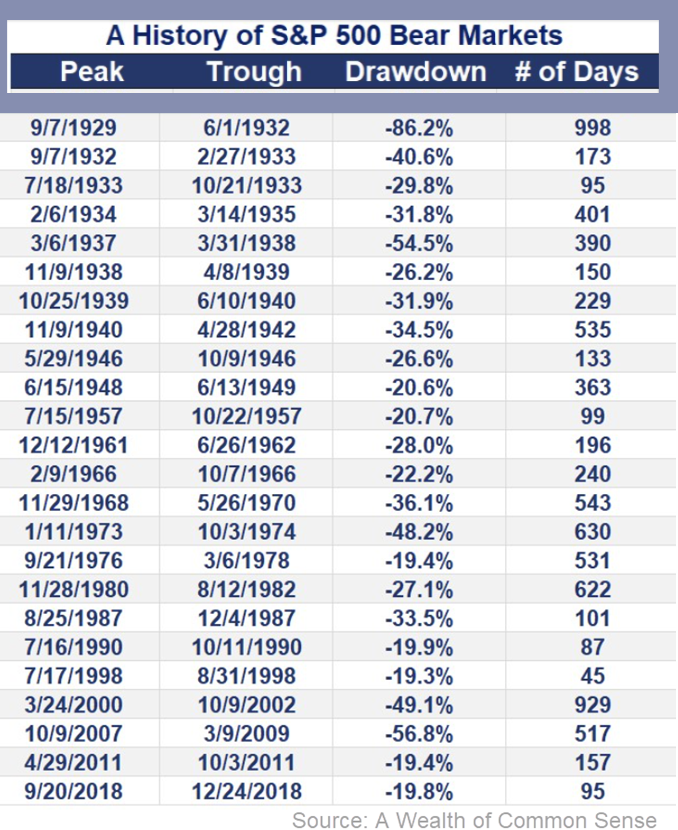

- The early 2000s dot-com bubble led to the second-longest bear market in history, which lasted 929 days and a 49.1% decline.

- The March COVID bear market in 2020 was the shortest in history, which lasted 33 days and declined 33%.

- Excluding the longest and shortest bear markets, the average length of a bear market is around 330 days — or just under one year and more extended bear markets are closer to two years.

- The average bear market drawdown is approximately 33%.

If today’s stock market follows a similar time and price trajectory, the current bear market will last much longer than many people anticipate.

- Market conditions and price action will ultimately decide whether the S&P 500 sees lows of 3300, 3250, 3000, 2900, or even lower lows.

- The S&P 500 faces overhead resistance at 4,000, 4,100, 4,150, and on overhead resistance 5,000 will be a number that will be hard to cross for a long length of time.

At MarketGauge, we take advantage of down trends and bear market rallies if we can profitably participate.

Despite volatile financial markets this year, we are proud that many of our investments have held firm and have even grown. This provides confidence in our proprietary investment strategies and our execution to manage strategies for maximum returns while limiting drawdowns.

Fortunately, we have seen success with several strategies delivering positive returns despite these trying times. The chart below shows a recent sample of a few profitable trades.

- Smart investors know the importance of inflation protection.

- Is Silver About to Outshine Gold?, on September 20, 2022.

- Mid-September column highlights.

- This Commodity Will Sweeten Your Returns in early December.

Rigorous analysis and a well-crafted trading plan are crucial to trading success in bear markets. It also helps to have multiple decades of trading experience at your fingertips and proven trading indicators to guide you.

As 2023 approaches, it is helpful to keep in mind the lessons of the past while focusing on executing risk-managed trades that are profitable today like silver as an example highlighted below.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 380 support and 390 resistance

Russell 2000 (IWM) 170 pivotal support and 180 resistance

Dow (DIA) 330 support and 337 resistance.

Nasdaq (QQQ) 269 support and 278 resistance

Regional banks (KRE) 53 support and resistance 61.

Semiconductors (SMH) Support is 205 and 217 resistance.

Transportation (IYT) 211 pivotal support and 222 is now resistance.

Biotechnology (IBB) 130 is pivotal support and 139 overhead resistance.

Retail (XRT) 57 pivotal support and 63 is now resistance. Regained 60.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.