With bank earnings the big buzz this week, here are some highlights to keep in mind.

Bank earnings are set to tank 69% year-over-year for the second quarter.

But it is not the expectations, rather whether or not those expectations are exceeded.

Analysts are worried about huge value of loan-loss provisions being set aside for bad loans/delinquencies- currently at nearly $53 billion. Several analysts expect it to climb even higher in Q2.

Morgan Stanley and Citigroup are favored to ride out the storm “given they have the least rate sensitivity”. Also, big banks continue to see a boost to fee income from elevated investment-banking and trading activity.

This uncertainty, in the face of crazy high valuations in tech and NASDAQ, has me focusing on not only the banks, but also junk bonds.

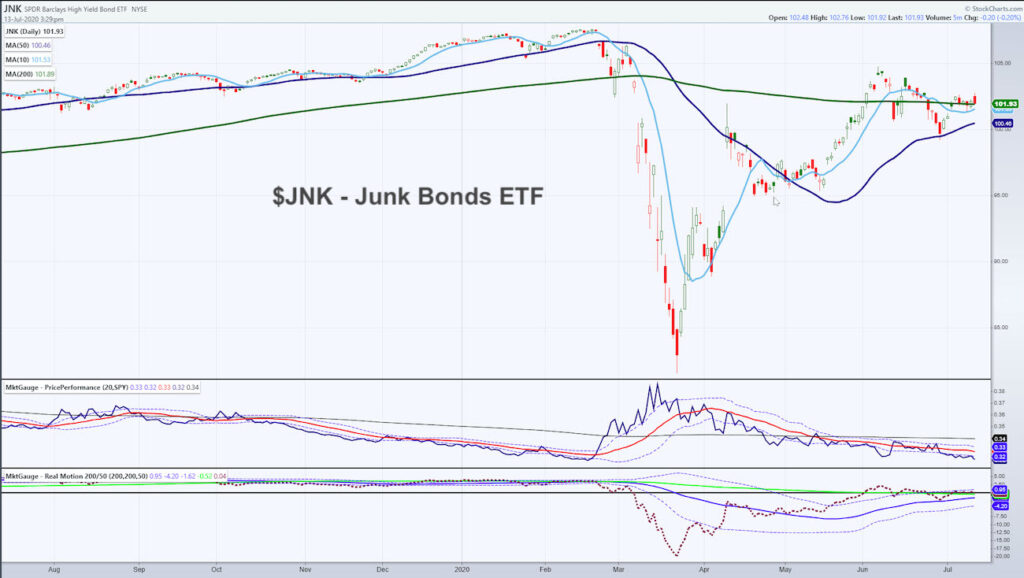

Back in February, before the news that the Banks might (and did) buy high grade yield and junk debt, I began to focus on the junk bonds.

As one of the first instruments to crash, the Junk Bonds ETF (JNK) fell from 110 down to 83.18.

Then, bank buying began and with a quick bottom reversal pattern, June Bonds (JNK) climbed all the way back to 103.48, made in April.

Since then, with NASDAQ, TECH and TSLA roaring, JNK has not done too much. In fact, it has underperformed.

So today if risk appetite, which has already waned, continues to wane, watch JNK carefully.

100-101 is support to hold. If the Junk Bonds ETF breaks those levels, then a move near 95.00 and then 90.00 could happen swiftly.

And that would take money out of equities and send money back to bonds and volatility.

S&P 500 (SPY) 318.22 gap was filled. After trading to 322, it closed on the 10-DMA support at 313.

Russell 2000 (IWM) 137 support 146.00 resistance

Dow (DIA) Tried to clear 262.45 and then failed it. Was this the top? A lot will depend on the bank earnings

Nasdaq (QQQ) Sharp reversal that has yet to confirm-now the true test begins in the sectors we need to hold

KRE (Regional Banks) An actual ray of hope in one of those key sectors I mention. 34.00 key support

SMH (Semiconductors) 160 was my target and why we have them. Reversal top possible, but needs to confirm

IYT (Transportation) 161.50 pivotal support 170 resistance

IBB (Biotechnology) Interesting reversal here. Lets see if 136 holds

XRT (Retail) 43.40 pivotal

Volatility Index (VXX) Unconfirmed bullish phase-has to confirm

Junk Bonds (JNK) 104.50 resistance 101.50 support then 100

LQD (iShs iBoxx High yield Bonds) 134.90 support key

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.