The precious metals sector continues to be a “grind”, offering a few trades but mostly sideways to lower action.

Gold prices have slogged along and this had held the Gold Miners (NYSEARCA:GDX) back… until recently.

The Gold Miners (GDX) and broader Mining Index (XAU) came to life in September and October.

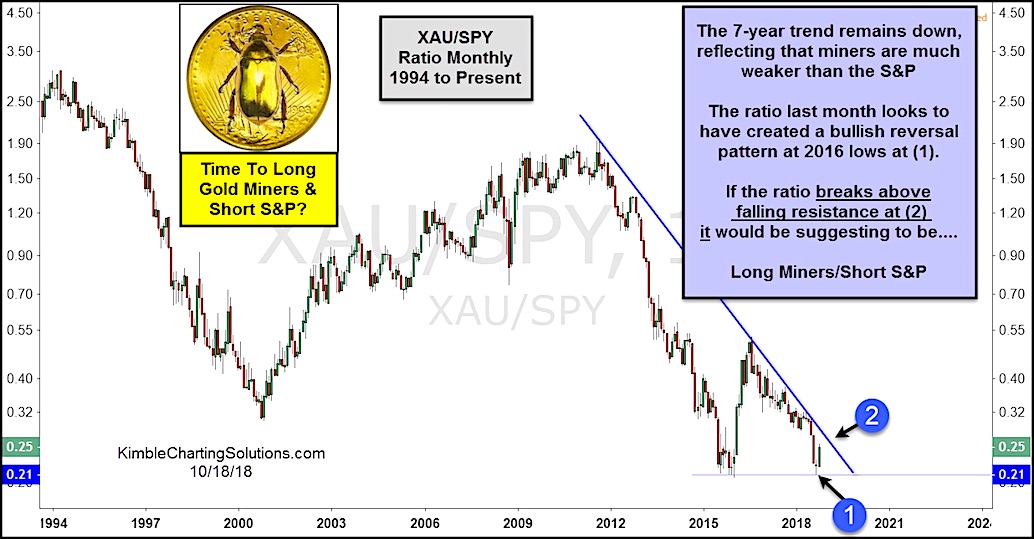

The miners are in a multi-year down trend, however there is a potential bullish setup in place. See the chart below where we highlight the ratio of the Mining Index (XAU) to the S&P 500 (SPY).

The ratio, which Gold Bugs want to see rising, looks to have created a bullish reversal last month at the 2016 lows at point (1).

And October is seeing a follow through move to the upside.

If the ratio breaks out above falling resistance at (2), it would be suggesting a long miners / short S&P 500 trade.

Mining Index (XAU) / S&P 500 (SPY) Ratio Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.