Global stock markets have staged a nice, at time uneven, rally over the past several weeks.

That rally has seen the U.S. stock market indices lead world markets higher.

This is clear in today’s chart 2-pack. But there’s more to the story…

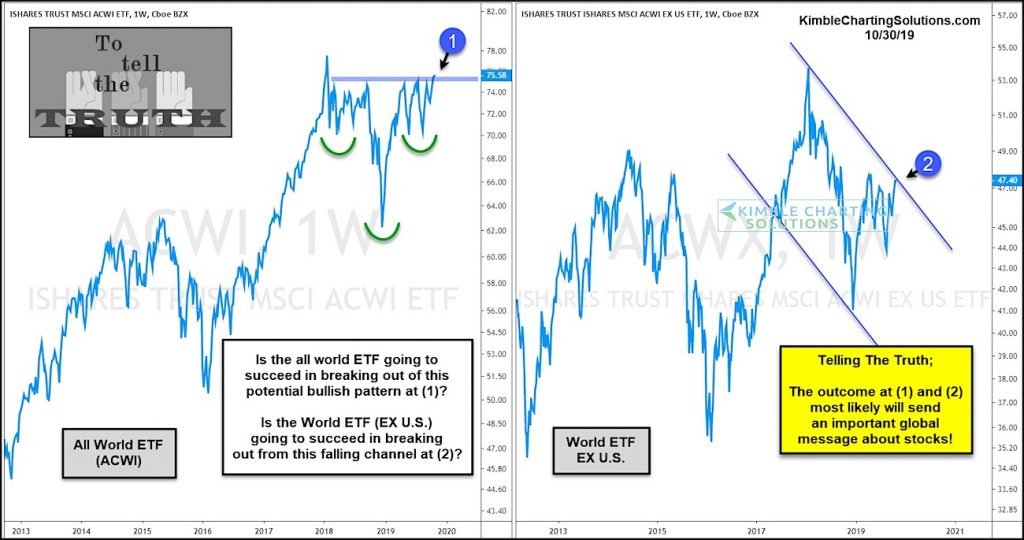

In the chart below, we look at the iShares ACWI All World ETF NASDAQ: ACWI and the iShares ACWI All World ex-U.S. ETF NASDAQ: ACWX. You can see that while the ex-U.S. ETF is lagging, they are both testing key breakout resistance at points (1) and (2).

It’s an important juncture for active investors and the outcome should be telling.

In short, what these two ETF’s do at points (1) and (2), will tell an important message about stocks around the world. Hint: Bulls want to see each hurdle cleared. Stay tuned!

ACWI All World ETF vs All World ETF ex-US

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.