Last week the Dow Jones Industrial Average was down 1.7% adding to a loss of 1.8% the previous week and the S&P 500 Index lost 2.5% on top of the 2.3% loss the previous week.

The tech-heavy NASDAQ lost 4.1% adding to its 3.3% loss the previous week. Futures are bouncing today and

There have been warning signs of a pullback in the stock market.

The high tech large capitalized stocks had experienced a very quick move up over a short time. Since the mega-cap stocks — Amazon, Microsoft, Apple, Facebook and Google — comprise roughly 25% of the market capitalization of the S&P 500, a pullback in these stocks will inevitably pull the rest of the market down.

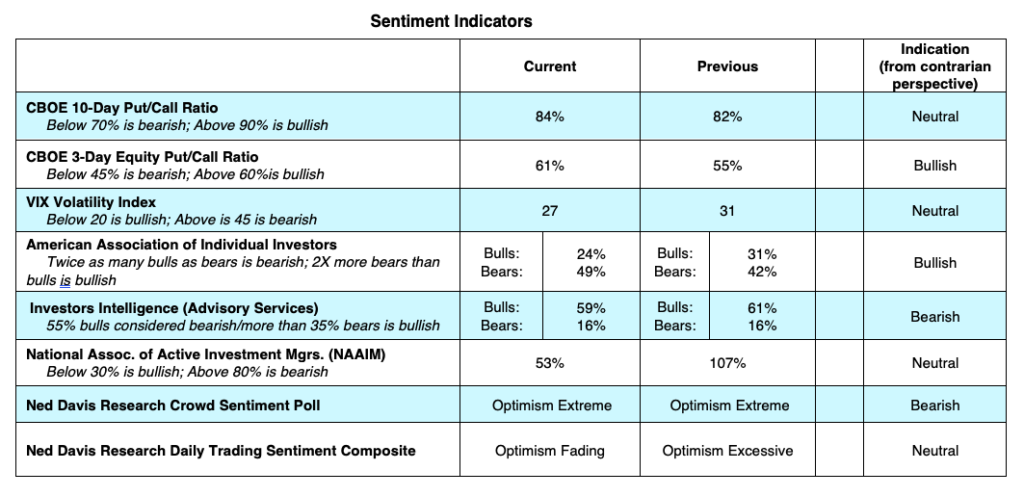

Additionally, as the stock market was rising, breadth was deteriorating with fewer stocks trading above their 200-day moving average. Technical indicators were pointing to fully invested mutual funds and record call volume at the Chicago Board Options Exchange suggesting too much optimism in the market, which often signals a pullback.

The correction in the markets over the past two weeks has helped relieve the excessive optimism in the market. Individual investors as well as active money managers have become more cautious. However, in spite of the recent sell-off, speculation in the options market is still alive and well and will likely contribute to ongoing market volatility.

Technology companies will continue to offer growth prospects due to work-from-home trends in business, education, entertainment, medicine and shopping. But expectations for the mega cap tech sector are tempered by soaring valuations in terms of price-to-earnings ratios and stronger antitrust regulations from the federal government likely coming soon.

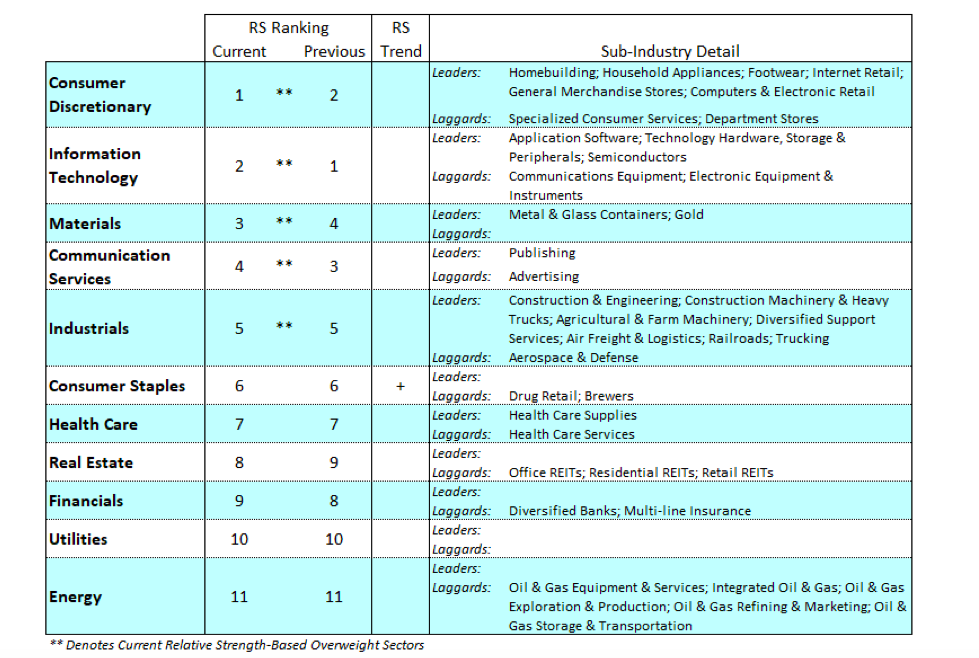

The past two weeks have seen a shift into the economically sensitive cyclical sectors as well as the cheaper valuation areas such as the small- and mid-capitalized stocks. These stocks were hit particularly hard in March and April of this year as smaller caps generally struggle in an economic downturn. As the economic data continues to point to a gradual recovery, investors should consider small- and mid-cap stocks in the strongest sectors of the market which are consumer discretionary, information technology, materials, communication services and industrials.

A significant decline in the market would likely be triggered by a setback in our progress in overcoming the COVID‑19 virus and/or higher inflation or rising interest rates. There is continued progress in testing and treatments for the virus. The Federal Reserve is committed to keeping U.S. interest rates lower for longer and monetary policy accommodative.

The Senate failed to pass a much-needed COVID-19 relief package for individuals and small businesses. They are back at the drawing board and we will hopefully see a relief package from Congress by the end of September. Going forward, the possibility of a too close to call unresolved presidential election and indecision on the federal stimulus package will likely weigh on stocks. If we get the additional aid package from Congress and with over $3 trillion parked in money market funds and with low interest rates and a vaccine on the way I expect to see consumer and business confidence improve which translates to a growing economy and a strong stock market.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.