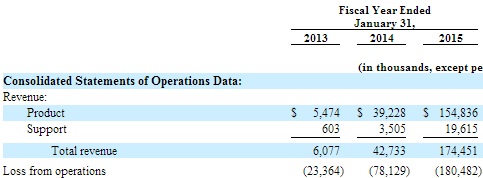

The super fast growth in this competitive landscape comes at a heavy price and Pure Storage cash burn rate has been white hot. See revenue growth and cash burn rates below.

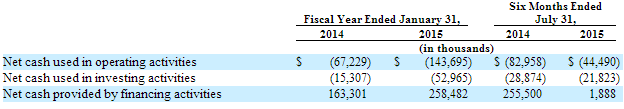

Operating margins have been in deep dive mode but while still deep in the red are showing some signs of rapid improvement with the company targeting 15%-20% operating margin in the future.

To date Pure Storage has raised $530 million in 8 rounds of financing and is looking to raise another $450 million in the IPO. The lastest round of financing was done in 2014 at a more than $3B valuation; Pure Storage definitely qualifies as a unicorn. About $80 million of the money raised pre-IPO was used in 2013 and 2014 to repurchase stocks from founders, executive and directors – this type of early cash out is not something that I like to see, but it’s there…

$500 million+ of VC/private money raised in 8 rounds of financing and burning cash like there is no tomorrow, that is also very reminiscent of another unicorn: Box (BOX)…

Pure Storage has a very strong pedigree of backers, from the founders of VMware, Greylock Partners, Reppoint Ventures, Samsung venture capital arm, the former CEO of Data Domain (acquired by EMC for $2.1 billion, to In-Q-Tel (associated with the US Central Intelligence Agency), and more recently from 3 now regulars in pre-IPO unicorn financing rounds: T Rowe Price, Wellington Management and Tiger Global.

Pure Storage IPO is also brought to market by a very solid syndicate of underwriters. With the best names on the street on the front cover, that will likely insure a successful debut for the stock. So far, the deal looks indeniably hot (oversubscribed, likely to price above the range) and will likely be chased by investors eager to participate in the growth of the technology. I expect the deal to do well out of the gate, but longer term a lot of questions regarding how Pure Storage will be able to achieve profitability in the fast moving and ultra competitive landscape remain.

Given how hot and competitive the space is, my guess is that Pure Storage stock will likely become one of the favorites for the rumor mill chatter of “so and so is looking to acquire Pure Storage”.

This deal reminds me of another one in the space, Fusion-IO (FIO). It was surrounded by much hype and acquisition rumors but in the end disappointing, being acquired by SanDisk at a price below the IPO price (and well below where it traded soon after the IPO).

Pure Storage (Nasdaq: PSTG)

Shares to be outstanding post IPO: 185,056,764

Price range: $16.00 – $18.00 – Pricing scheduled for Tuesday night, trading Wednesday.

IPOs of note also scheduled for the week of October 5th:

Aclaris Therapeutics (Nasdaq: ACRS) – A clinical-stage specialty pharmaceutical company focused on identifying, developing and commercializing innovative and differentiated topical drugs to address significant unmet needs in dermatology.

Aclaris Therapeutics (Nasdaq: ACRS) – A clinical-stage specialty pharmaceutical company focused on identifying, developing and commercializing innovative and differentiated topical drugs to address significant unmet needs in dermatology.

It’s lead drug candidate, A-101, is a proprietary high-concentration hydrogen peroxide topical solution developed as a prescription treatment for seborrheic keratosis, or SK, a common non-malignant skin tumor.

Shares to be outstanding post IPO: 19,407,503

Price range: $14.00 – $16.00 – Pricing scheduled for Tuesday night, trading Wednesday.

CPI Card Group (Nasdaq: PMTS) – A leading provider of comprehensive Financial Payment Card solutions in North America. Financial Payment Cards: credit, debit and Prepaid Debit Cards issued on the networks of the Payment Card Brands (Visa, MasterCard, American Express and Discover) and Interac (in Canada).

CPI Card Group (Nasdaq: PMTS) – A leading provider of comprehensive Financial Payment Card solutions in North America. Financial Payment Cards: credit, debit and Prepaid Debit Cards issued on the networks of the Payment Card Brands (Visa, MasterCard, American Express and Discover) and Interac (in Canada).

Shares to be outstanding post IPO: 50,458,469

Price range: $16.00 – $18.00 – Pricing scheduled for Wednesday night, trading Thursday.

CytomX Therapeutics (Nasdaq: CTMX) – Oncology-focused biopharmaceutical company pioneering a novel class of antibody therapeutics based on Probody technology platform. Using platform to create proprietary cancer immunotherapies against clinically-validated targets as well as to develop first-in-class cancer therapeutics against novel targets.

CytomX Therapeutics (Nasdaq: CTMX) – Oncology-focused biopharmaceutical company pioneering a novel class of antibody therapeutics based on Probody technology platform. Using platform to create proprietary cancer immunotherapies against clinically-validated targets as well as to develop first-in-class cancer therapeutics against novel targets.

Shares to be outstanding post IPO: 34,924,789

Price range: $14.00 – $16.00 – Pricing scheduled for Wednesday night, trading Thursday.

Digicel Group (Nasdaq: DCEL) – A leading provider of communications services in the Caribbean and South Pacific regions, providing a comprehensive range of mobile communications, Business Solutions, Cable TV & Broadband and other related products and services to retail, corporate and government customers.

Digicel Group (Nasdaq: DCEL) – A leading provider of communications services in the Caribbean and South Pacific regions, providing a comprehensive range of mobile communications, Business Solutions, Cable TV & Broadband and other related products and services to retail, corporate and government customers.

Digicel currently provides mobile communications services to 13.6 million subscribers in 31 markets with an aggregate population of approximately 32 million people

Shares to be outstanding post IPO: 317,548,276

Price range: $13.00 – $16.00 – Pricing scheduled for Wednesday night, trading Thursday.

Strongbridge Biopharma (Nasdaq: SBBP) – Dual listing. Biopharmaceutical company focused on the development, in-licensing, acquisition and eventual commercialization of multiple complementary products and product candidates within franchises that target rare diseases.

Strongbridge Biopharma (Nasdaq: SBBP) – Dual listing. Biopharmaceutical company focused on the development, in-licensing, acquisition and eventual commercialization of multiple complementary products and product candidates within franchises that target rare diseases.

It’s primary focus has been to build rare endocrine franchise, which includes product candidates for the treatment of endogenous Cushing’s syndrome and acromegaly, two rare diseases with a high unmet need for innovative treatment options

Shares to be outstanding post IPO: 22,955,382

Price range: $17.00 – $18.00 – Pricing scheduled for Thursday night, trading Friday.

IPOs offer a lot of opportunities but also come with their own set of risks. As well, they are generally riskier than stocks that come with a long history as a public company. One should expect very wide trading ranges, lower liquidity and much higher volatility from IPOs than the rest of the market. Investors must always factor this into their assessment before trading or investing in IPOs.

For complete information on this weeks IPOs, refer back to the SEC offering prospectus: https://www.sec.gov/search/search.htm

Thanks for reading.

Twitter: @JFinDallas

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.