I have studied patterns for a long time. And as a trader, I’m fascinated with price patterns that develop in the financial markets. Today I want to look at an important chart pattern in the works on the S&P 500 Index (INDEXSP:.INX)… and why we may be trading at a very important price level.

But before we discuss the current S&P 500 chart pattern and illustrate its importance, I want to remind you of three things regarding chart patterns:

- PATTERNS… work and they fail.

- PATTERNS… tell us of possible inflection points.

- PATTERNS… tell us very important price areas of interest to trade around.

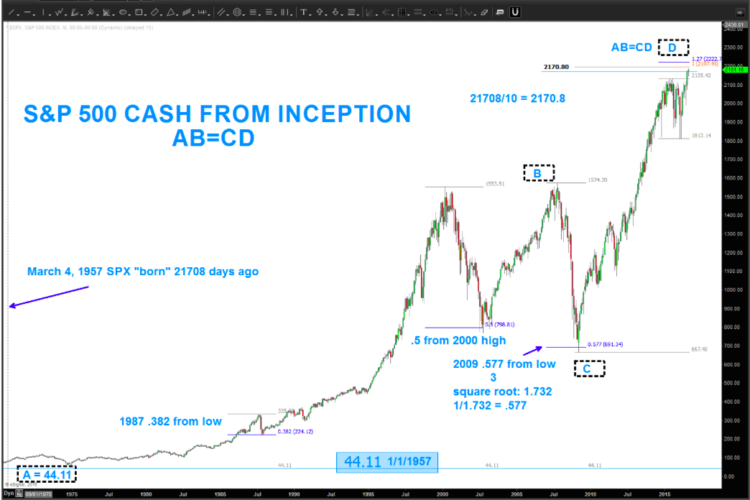

Looking at the chart below, it’s clear that the S&P 500 is nearing an important price area. A classic AB=CD pattern may be completing.

We want to manage risk and trade about this area because the outcome for “traders” is somewhat binary.

For instance, it may be finishing or very close to finishing a sell signal. That would mean we are at major resistance and the market “should” respect a PATTERN that has its genesis from it’s all time low 50 years ago….

However, if the market DOES NOT respect this price area and goes higher then that’s a signal that the market is really really strong and I will look to go long after a monthly or weekly close above this price area.

S&P 500 Chart Pattern – AB=CD

Thanks for reading and best of luck out there.

Twitter: @BartsCharts

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.