As they say, history often rhymes… But it rarely repeats. Or at least in the way that we imagine.

That’s not to say that looking back at fractals of stock market history isn’t beneficial. For one, it can help you manage risk as you assess the structure of a market decline against key market indicators.

However, each stock market decline comes at different stages of a market cycle and under different circumstances. In 2015, we were dealt an aging bull market that was adjusting to changing currency markets and a commodities shock (i.e. crude oil). I outlined the crosscurrents in “Confusion Reigns: Separating What’s Bullish From Bearish In The Markets“.

But dips (and corrections continued to be bought). Cases in point: The October 2014 sharp decline (and V bottom recovery) was bought, as was the August 2015 correction. So traders were still of the mindset that the bull market was alive and well and that pullbacks could be bought heading into 2016.

Here’s a look at a chart of stock market corrections since 2011:

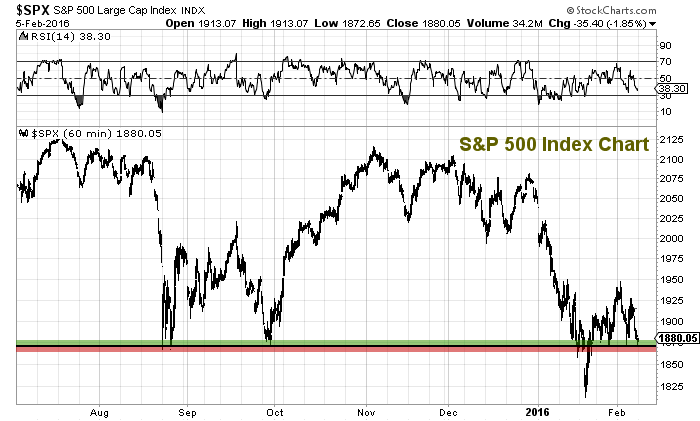

Enter 2016. The market correction has declined as much as 15.1% from the all-time highs (per the S&P 500). And currently, we are 12 percent off those highs… and fast approaching a market crossroads.

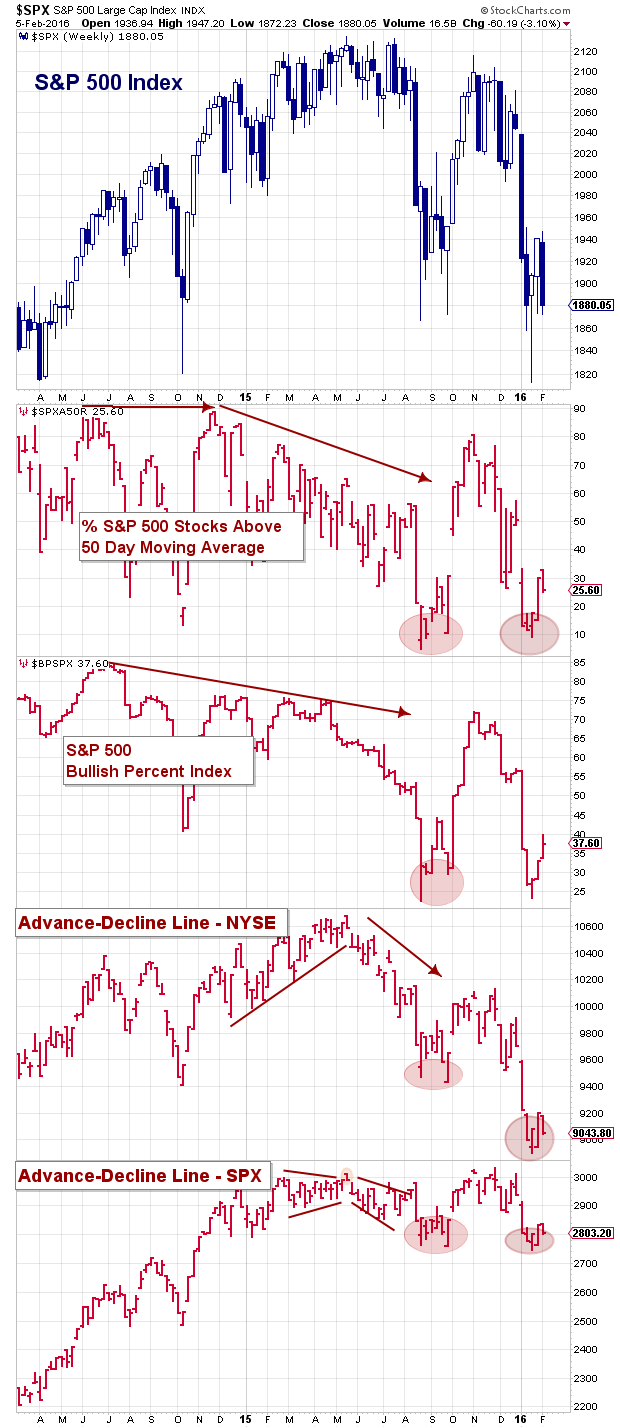

As you can see in the chart above, the S&P 500 Index undercut the August/September 2015 lows in January. We have since reclaimed that level but have struggled to build upon it. As well, if we understand that the S&P 500 actually peaked in May 2015, stocks have been under pressure for much of the last several months.

The price action leading up to and out of the August lows seemed awfully similar to 2015 and many analysts highlighted that. Those observations were helpful IF you were able to abandon that theory when the recovery began to struggle.

But to be fair, this market is nothing like 2011. Crude Oil has traded under $30 per barrel, the US Dollar has strengthened, and the US has terminated Quantiative Easing (and raised interest rates), while the rest of the world is doing anything and everything to stimulate their local economies and devalue their currencies.

As well, small cap stocks have been lagging and now high beta tech stocks have joined them (falling sharply last week).

The Technical Setup

Concerns about a deeper decline in equities are well-founded. And since the market tends to take the stairs up and the elevator down, I’d say that the coming weeks are VERY important.

If we go back 18 months and consider the October 2014 lows, we have traded in a sideways pattern with 3 market corrections. So the 1810 level (call it 1800) is a pretty important psychological support. The bulls would like to continue the sideways movement, albeit to the upside. This could help start the idea that we are correcting through time and price. That said, I’m still not sure we’ve seen true market capitulation. And that complacency leaves me concerned about the possibility of another dislocation now or sometime in 2016.

Near-term, the bulls really need to hold 1872 (especially on a closing basis)… if not, the next price level down is the psychological level of 1850. If the bulls don’t get some traction early this week, then look for more downside pressure.

Keep an eye on market breadth… it’s still unsettled. And as fellow contributor and RW Baird senior investment strategist Willie Delwiche has mentioned over the past couple of weeks, we’d like to see market breadth improve as prices remain suppressed (i.e. form a divergence).

The good news?

Stock Market corrections produce deep skepticism and tend to turnover a new leaf. We just have to proceed with caution as the market environment changes. (See fellow contributor Dan Neagoy’s post from earlier today).

So if/when this decline is over it will produce some great opportunities for investors with capital.

Trading Psychology

There is no need to be a hero here. I often remind traders (and myself) that position size matters… especially during uncertain markets. We are constantly thinking about what we might miss out on… and that can be dangerous. If you really want to play along, just be sure the size of your allocation or position size is reflective of the risk at hand. Our capital is the single most important thing as traders and missing out on a trade isn’t nearly as bad a forcing yourself into a terrible one.

Thanks for reading and good luck this week.

Twitter: @andrewnyquist

The author holds exposure to related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.