“My goal to simplify complexity.” – Jack Dorsey

We have been following society’s secular movement away from cash and towards digital payments for some time now.

The COVID pandemic has only accelerated this trend, with an increasing share of businesses going cashless and moving toward a cashless society.

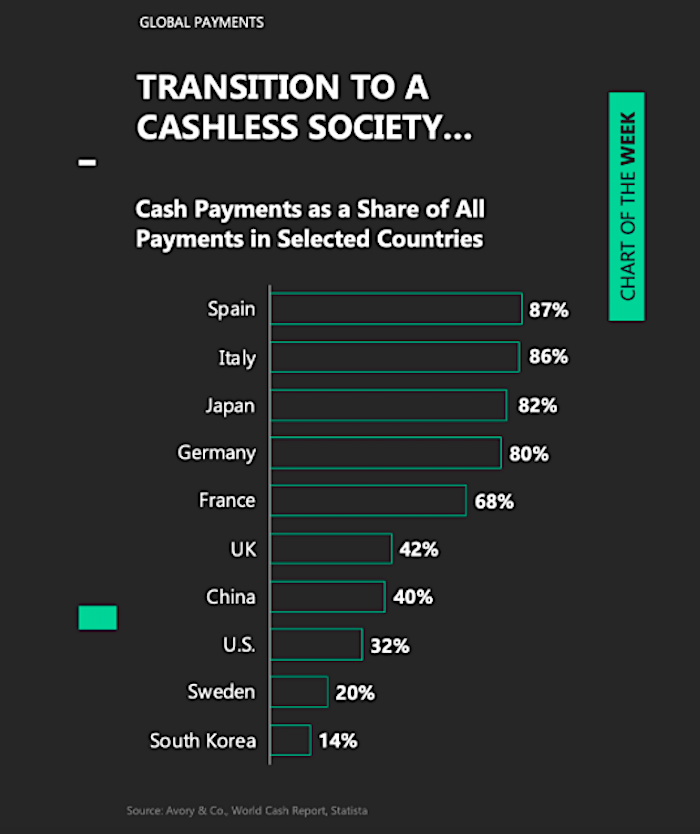

Taking a step back and looking at the share of payments in cash across the world shows an interesting picture.

South Korea is a leading “cashless society” with cash comprising around 14% of payments. In Spain, 87% transactions still take place with cash.

The Future of Payments

It’s no surprise that COVID has permanently impacted consumer behavior. We mentioned in a previous chart segment how Square witnessed a significant increase in cashless sellers throughout the peak months of the pandemic.

In addition to that, society is experiencing a secular movement to business models which are largely digital – examples include e-commerce. And this only accelerates the cashless society trend forward.

As this continues, a larger share of payments will move away from cash and take place either digitally through cards, or through potentially other methods.

It’s interesting to think of the players involved all throughout the space, and what the landscape could look like down the road. Visa and Mastercard continue to serve as a layer of infrastructure in payments, while other companies like Square and PayPal sit closer to the consumer through their mobile payment apps Cash App and Venmo, respectively.

Twitter: @_SeanDavid

The author or his firm have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.