The Vibe: A quick, and I mean quick weekly or even bi-weekly rundown of the things Sean Emory is seeing in the market RIGHT NOW. An emphasis on broad markets, single equities, and anything in between. It’s low key good.

The Details:

Investor sentiment picked up dramatically following the Trump victory in November. The market rewarded US everything, as the broad S&P 500 (NYSEARCA:SPY) is well off the November lows, including many of the highest regulated sectors such as Financials. However, as more and more investors have gone on air suggesting to buy small caps, the US dollar, stay only in the US, and sell bonds (NASDAQ:TLT), the opposite is starting to occur. I think being the contrarian here is the most prudent think to do, however pick your spots.

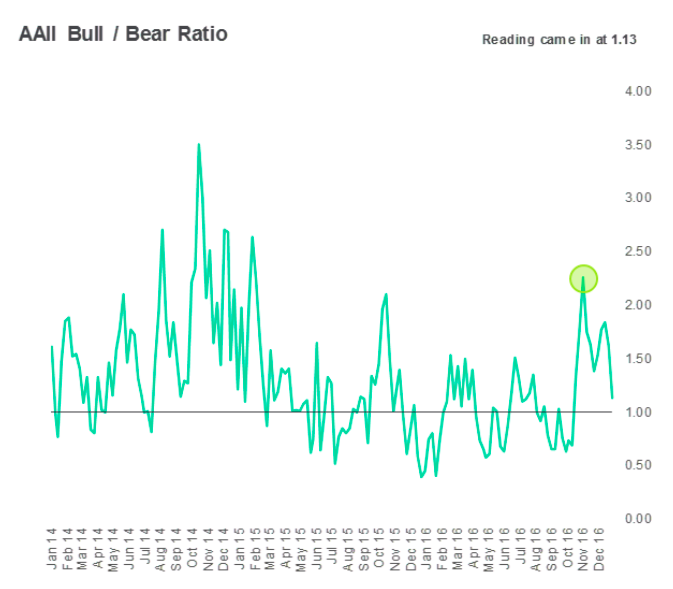

Investor Sentiment

Following the crowd can be dangerous, and post the elections the crowd was very bullish. I think the bullishness is warranted to some degree, but we may be seeing some pressure. Below is the bull to bear ratio from AAII investor sentiment as of last week. The ratio reached the mid 2’s and still remains above 1.

Financials ETF XLF

The Financial sector saw some of the biggest gains in the market. Again this euphoria was primarily driven by higher yields and hope for de-regulation of the sector. No question both of those are great for the sector, however it will take time, and some will win more than others. Looking at the chart we started to see some sideways action, this is healthy after a strong rally, however the decline in momentum is noticeable, and price is starting to move below its short term channel.

10 Year Treasury Yield

The yield on the 10 year has been estimated by many firms to top 3% in 2017 on the back of higher inflation and higher growth. There are some signs of both of growth and inflation, however we question whether these estimates are once again moving ahead of themselves as they did in 2013? Further dissecting the most recent move, we have seen was a sharp rally to an important 2.5% level, however, price quickly broke back below. I think this is dangerous for those thinking yields will continue to rise here and this is one of my favorite contrarian plays. 2.5% is the key area to follow.

US Dollar Index (DXY)

The dollar was pressuring the Tech sector following Trump’s victory as over 50% of Tech revenues come from overseas. The dollar index has been weak as of late and has given back roughly 3-4% over the last month. There is no coincidence that the Nasdaq is leading the market in 2017. A break below the green line which sits at around 100, would be beneficial to Tech once again, and likely lead to continued tech relative outperformance.

Small Caps ETF IWM

Small caps look alot like Financials in that they rallied strong post the Trump victory. However, like Financials, small caps are moving below its short term channel on strong negative price momentum. Small caps look vulnerable here to a 6-8% pull back.

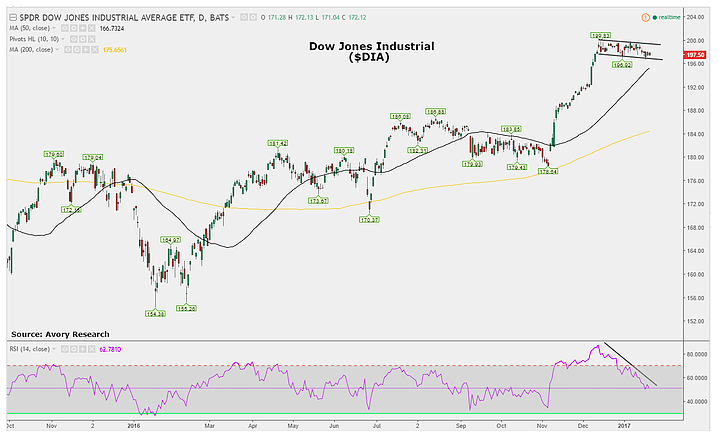

Dow Jones ETF DIA

This takes me to the giant, the Dow Jones. The Dow is showing similar price action to micro and small caps, however it has not broken down yet. Price momentum as shown by the RSI is sharply lower, and in my view suggests we may see pricing pressures here shortly.

The Vibe:

So to me the market looks and feels as though it needs a breather. The more aggressive parts of equities are starting to fall. Small caps look as though it could suffer 3-5% drawdown, and Dow Jones is on the verge of some weakness. Bonds on the other hand continue to be the contrarian play as TLT has been up 4 of the last 5 weeks. The US Dollar is at 100 once again, and technology is enjoying the dollar weakness. So all in all, sentiment moved too far too fast and prudent investors should remain patient and pick their spots.

Thanks for reading.

Twitter: @_SeanDavid

Read more from Sean on his blog, the Market Meter.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.