The path to maximum wealth creation is to bet the farm on one security — you just have to pick the right one. Just ask Jeff Bezos or Bill Gates.

Unfortunately, making the right choice is either impossible or simply luck with incredibly impossible odds. Ask Christian Gronet (Solyndra) or Julie Wainwright (Pets.com): lesser-known innovative founders that just didn’t make it.

So, investors opt for the safer and more reliable plan B to reach their long-term goals; instead of shooting for the stars, diversify your portfolio by style, geography and most importantly by asset class. The biggest component for most portfolios is asset class diversification, primarily the combination of equities/stocks and bonds.

The foundational reasons to combine stocks and bonds are intuitive. If the economy is doing well, earnings are growing which helps the stock market perform well. However, an economy that is doing well is inflationary which pushes up yields, hurting bond prices. If the economy is doing poorly, the opposite should occur with stocks down and bonds up. Stocks and bonds should be negatively correlated and provide great diversification if combined — the mythical smooth ride. Simple, right?

If only investing was that simple. The fact is there are many factors at play, and this results in changing correlations between asset classes over time. Today we are going to talk stock and bond correlations. For obvious reasons there are many upset investors (and portfolio managers) who don’t like the fact that stocks and bonds have been moving in the same direction as one another (positively correlated). Everyone expects a degree of volatility in equities, but it sure helps the portfolio during periods that equities are going down if your bonds go up. That has not been the trend of late.

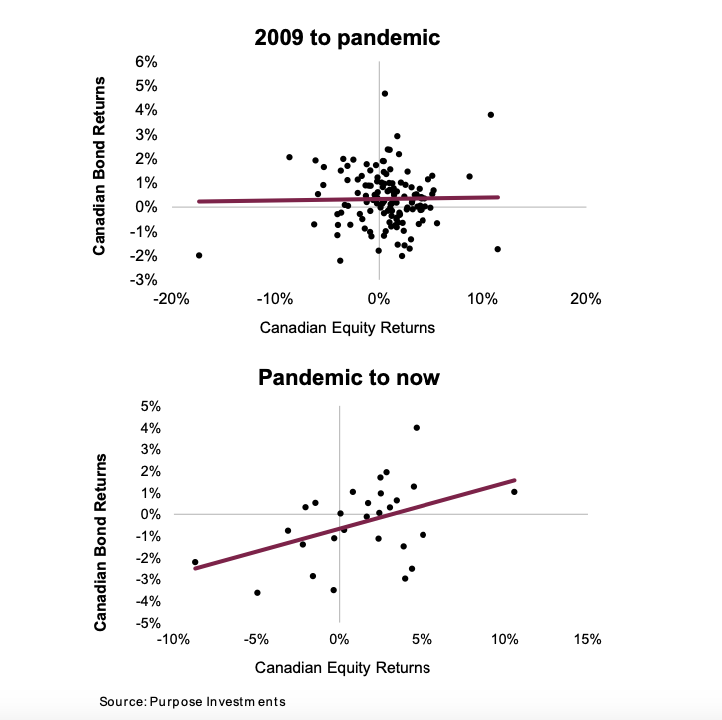

It is easy to see in the above scatter plots of monthly stock/equity returns versus bond returns [the purple line is the trend]. From 2009 until the onset of the pandemic in March 2020, monthly returns between stocks and bonds were all over the place and didn’t show much of an underlying relationship. This would be ‘uncorrelated,’ which helps a portfolio’s diversification as the two assets behave rather independently. The second chart shows the relationship from the onset of the pandemic until now displays a different pattern with just two months where stocks were up and bonds down. And there are many months where both stocks and bonds were lower or higher together. Again, this provides less diversification benefit if they are moving in the same direction.

So, have market dynamics changed to neutralize the benefits of combining stocks and bonds in a portfolio? Not so fast. First off, there are so many strange dynamics afoot in the markets today given the lingering reverberations caused by the pandemic, so jumping to conclusions is not a good idea especially throwing out decades of data because of a year or so. The fact is correlations do change over time and they are currently more positive.

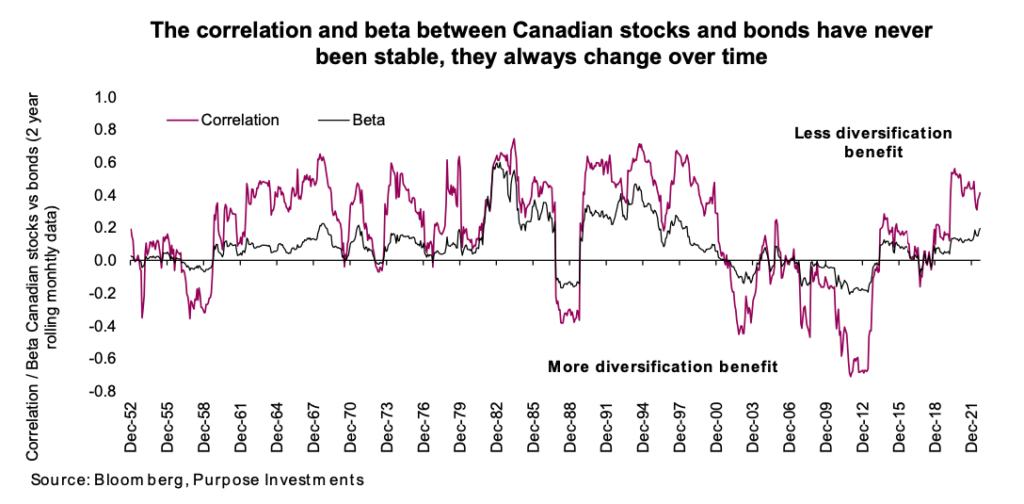

Truthfully, correlations between stocks and bonds have been positive for a few years now, not just in 2022. Nobody minded the positive correlation when stocks and bonds were moving higher together. As you can see in the above chart, from 2000-2020 correlations were low or negative for most of that period. Not so in the 1990s or earlier.

If correlations are going to remain high, does this negate the benefit of stock and bond diversification? No. It may soften the benefit but correlation measures direction, not magnitude. That is where Beta comes in, measuring the degree of the move in stocks and bonds (see the thin black line in the chart above). Over the past two years, the correlation between bonds and stocks has risen to roughly 0.5 but the beta remains low at about 0.2. This means if your stocks fall 5%, bonds should fall by 1%. Since down 1% is better than down 5%, there is still a benefit.

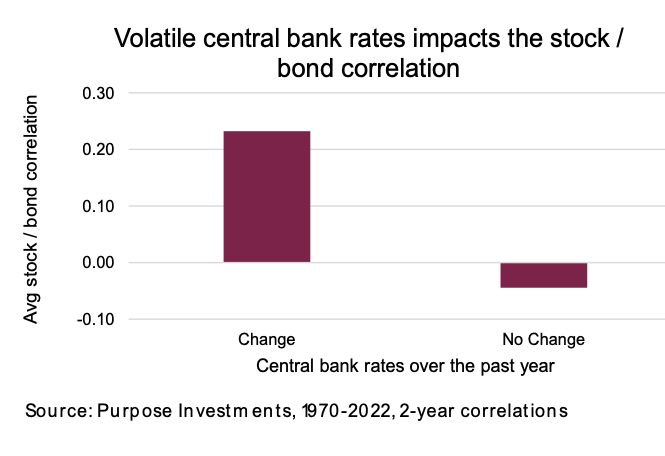

The high correlation won’t stay high either. One factor that does appear to have a strong relationship with the stock to bond correlation is the variability in central bank rates. When central bank rates are moving, the stock to bond correlation tends to be much higher. When central bank rates are stable, the stock to bond correlation tends to be much lower. This certainly makes sense. Changes to the central bank overnight rate changes the risk-free rate, either up or down. The risk-free rate is a component in the valuation of both stocks in bonds, so changes impact both asset classes in the same direction.

Impact on portfolios

The outlook for central bank rates certainly points to continued action in the current fight against inflation. The bad news: this will contribute to keeping the stock to bond correlation higher. However, higher correlation isn’t always bad. When inflation starts to roll over, the market will likely start to price in a cooling of the overnight bank rate, which may very well lift the prices of both stocks and bonds simultaneously — positive correlation.

The yin and yang of stocks and bonds isn’t broken; maybe people just thought it was a hard rule or constant instead of a variable relationship over time. The diversification benefits between stocks and bonds may not be as strong as years past but it will be again. Certainly explore ‘new’ diversification strategies, but don’t change the core of portfolio construction because of a couple years of data. Besides, buying bonds that yield 5% does feel a lot safer than buying them a few years ago when they yielded just 2%. Bonds are starting to look like the ex you broke up with but has since been working out and has dramatically improved their sense of style – never say never!

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.