Just last week, I wrote about 13 percent correction that occurred over one week on the Shanghai Composite Index (SSEC). Well it’s now been a little over two weeks since the selling began and the Chinese stock exchange is currently down 21.7 percent off its highs (and from intraday peak to its current trough it’s been 25.7 percent). That’s quite a haircut for any stock market. Meanwhile, the S&P 500 is just 2.7 percent off its highs.

So is the damage done for Chinese stocks? Or is there more to come?

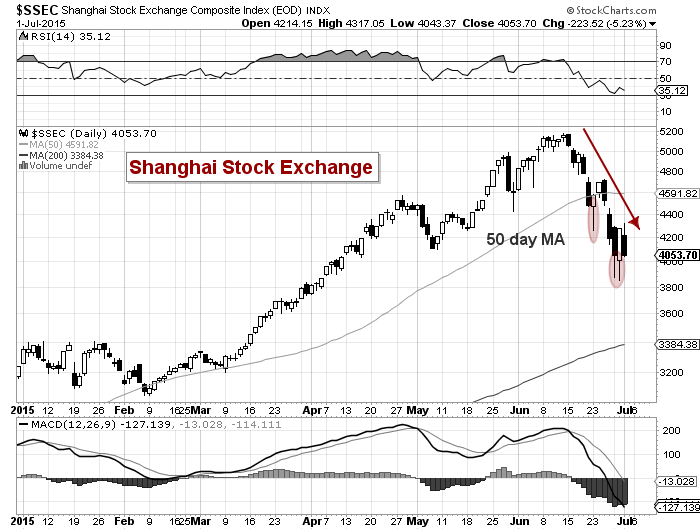

Anytime a market endures this much damage over such a short period of time, it typically requires some time to heal. That said, the lows from Monday and Tuesday may provide clues over the near-term. In each of those sessions, the market reversed deeper losses and put in bottoming tails. The lows also came in around the .618 Fibonacci retracement of the February lows to June highs. As well, the index of chinese stocks is getting oversold.

So near-term the Chinese exchange looks like it may be trying to bounce. But if those lows are taken out, then lookout below.

Shanghai Composite Stock Exchange

If the Shanghai Composite pushes higher in the days ahead, it will likely target a confluence of its downtrend resistance line, the 50 day moving average, and the big gap lower (all around 4450-4600). A break back above 4700 would likely neutralize the situation.

On the downside, support resides at the 200 day moving average and January highs (around 3400). That may be the next target, especially if the recent lows are broken.

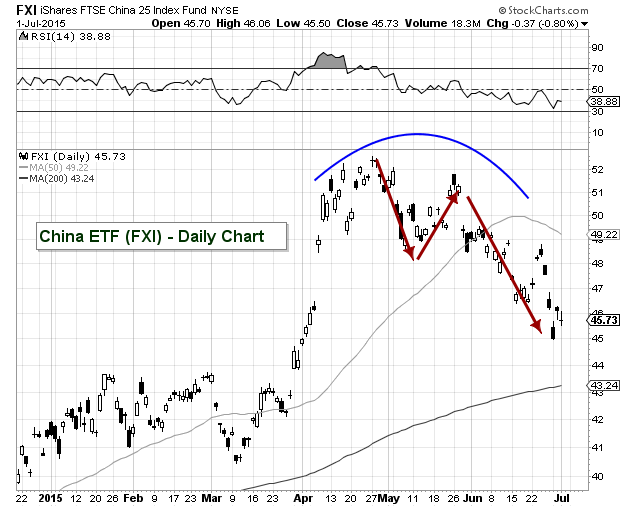

For reference, below is a chart of the iShares China ETF (FXI) highlighting similar selling (although the selling started a bit earlier). Either way, the Chinese stock market (and Chinese stocks) have been crushed of late.

Will the selling in Shanghai spill over to other markets? It hasn’t yet, but the swift downdraft shows us why we need to keep risk management at the forefront of our investment decisions. Thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.