Nearly six weeks ago, I wrote a piece on the Dow Jones Industrial Average (DJIA), which you may find here. Here’s a segment from that piece:

“I also reiterate the two facts that stand out that may prevent price action from moving higher at this point; an open gap below and low volume that has pushed up price to recent highs. We are also nearing the end of the first quarter contract, which may bring some volatility back into the market.”

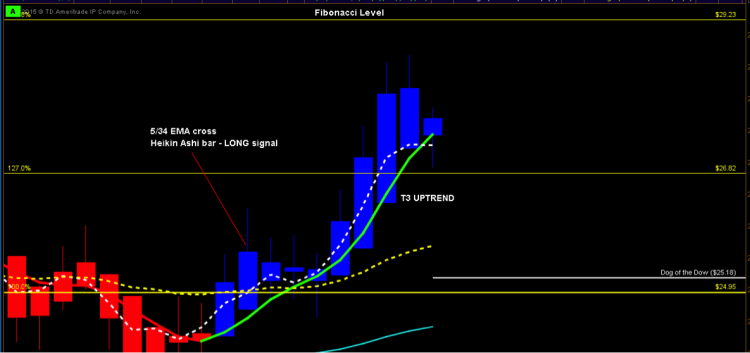

Since early March, the Dow Jones Industrial Average has struggled to break above a significant Fibonacci level. And with less than normal volume, it is no wonder that Friday’s selloff was just waiting to happen. What lies ahead is anyone’s guess: Half will get it right, and half will get it wrong.

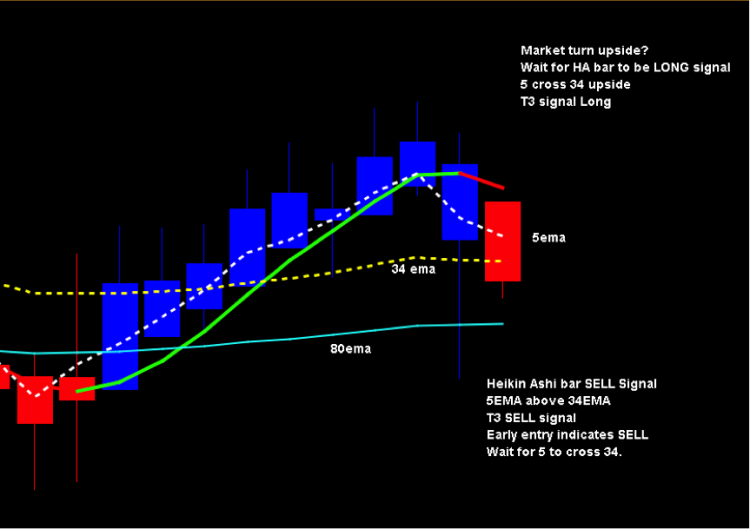

What can make investors prepared is knowing where the TREND exists and waiting for good entry points. The futures sit on a pivotal point here as the price action is poised to go in either direction. Intraday or swing, the setups are treated the same.

Trading the DOW 30 or the options? Heiken Ashi combined with moving averages can keep you in a long term trend. Looking for an entry point? Keep it simple and look for the moving average crossover. Here you can see General Electric (GE), a Dog of the DOW, has been performing well for 2015 so far.

The following video recap of the DOW 30 Stocks, ETF’s and futures will provides an in-depth analysis of where each chart is setting up for a trend move along with key levels to be aware of. I look at each of the DOW 30 stocks and share my thoughts on directional probabilities based upon current trend.

Thank you for viewing in advance.

Follow David on Twitter: @TradingFibz

The author has no positions in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.