After Facebook (FB) reported earnings, 22 analysts raised price targets. 22! That is a helluva clear sign the bull’s boat is getting full. That also shows a clear lack of diversity in opinion, which is a key characteristics of market reversal points.

Remember the monster earnings pop for Amazon (AMZN) that lasted 10-15 minutes in the open market before fading? This week, LinkedIn (LNKD) and Twitter (TWTR) enjoyed similar earnings pops that lasted all of ten minutes in after hours trading. Absurd moves are happening and smart money is cashing in immediately.

There are plenty of data and opinions out there that support nit picking bearish arguments. The main problem with that is the most important argument of all is PRICE. The major fibonacci extension levels in the S&P 500 and the Dow Jones Industrial Average continue to cap the markets. That continues to tell us there is limited upside on a broad market basis. If those levels break, we can adjust our point of view… but not until then.

Let’s hit the charts.

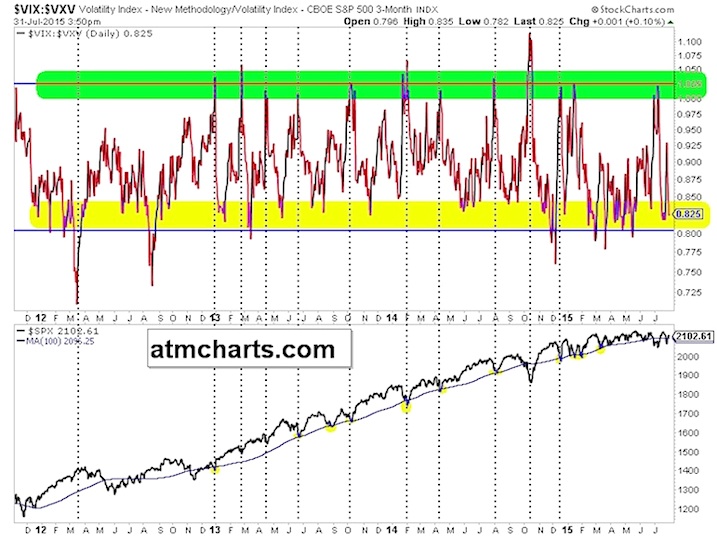

Once again, just like that the market is fearless again. Check out the VIX:VXV ratio below.

The Volatility Index (VIX)

Market breadth is trying to make a come back in the S&P 500. Note the ratio didn’t form a fresh low with the market.

Market Sectors

I’ve pointed out the action in Market Vectors Semiconductors ETF (SMH) throughout the week. Note the MACD bull cross. I’m looking to buy weakness early next week for a larger oversold bounce to test the 200 day moving average. This would be a much higher probability opportunity if the market wasn’t so ‘fearless’.

The 51.75 area looks pretty solid. Also note the daily Bollinger Band support around 51.

The Energy Sector ETF (XLE) tried to reclaim the winter lows and failed. This sector has traded woefully. Watch those lows.

The Utilities Sector ETF (XLU) are trying to break clear of resistance. They’ll likely be tied to bonds in the near future.

The Gold Miners Sector ETF (GDX) is coiling up here. The once left for dead group is showing signs of potential. It will need to breakout first, though.

Thanks for reading and good luck out there this week.

Twitter: @ATMcharts

Read more from Aaron on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.